Unsure how your goals and your money are connected? It’s not a trick question – but not everyone can immediately connect the two. That’s why your advisor asks questions throughout your relationship, to help ensure your money is aligned with your goals. This gives them the information they need to build investment strategies and planning solutions which helps give meaning to your money.

Offering wisdom of industry experience

With the LifeSync® process and their industry knowledge, your advisor can help you measure your progress toward your goals.

It’s no secret that markets move in cycles, historically most often in tandem with the ups and downs of the global economy. Lean years have followed boom years and market bubbles. Recessions have given way to periods of growth, stability, and investment opportunity. Your advisor can help you understand the historical movement of markets and they can recommend financial and investment strategies that aim to directly address your personal needs.

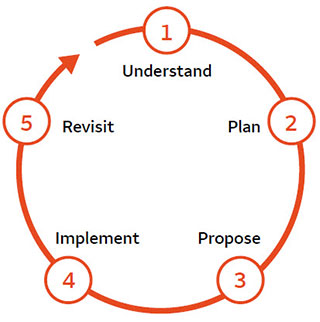

The LifeSync process

“Investment planning” can sometimes feel impersonal, like you’re receiving cookie-cutter investment or generalized guesswork regarding your financial needs. With our LifeSync process, we make planning interactive by starting with your life and planning your money around it.

The LifeSync process begins by understanding your goals. Your advisor will revisit your goals throughout your relationship and offer guidance along the way.

Acknowledging your goals

You likely have thought about short-term and long-term goals you have for yourself. Translating those goals to your money may be easy for some, and more difficult for others.

What jobs do you want your money to do? Discuss these with your spouse, partner, or a trusted advisor to ensure you are making the most impact with your money.