All investments are subject to market risk, which means their value may fluctuate in response to general economic and market conditions, the prospects of individual companies, and industry sectors due to numerous factors, some of which may be unpredictable. Be sure you understand and are able to bear the associated market, liquidity, credit, yield fluctuation, and other risks involved in an investment in a particular strategy.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers.

Investments in equity securities are generally more volatile than other types of securities. An investment that is concentrated in a specific sector or industry increases its vulnerability to any single economic, political or regulatory development affecting that sector or industry. This may result in greater price volatility.

Risks associated with the Technology sector include increased competition from domestic and international companies, unexpected changes in demand, regulatory actions, technical problems with key products, and the departure of key members of management. Technology and Internet-related stocks, especially smaller, less-seasoned companies, tend to be more volatile than the overall market.

There are no guarantees that growth or value stocks will increase in value or that their intrinsic values will eventually be recognized by the overall market. The return and principal value of stocks fluctuate with changes in market conditions. The growth and value type of investing tends to shift in and out of favor.

An index is unmanaged and unavailable for direct investment.

S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value.

Stanford University AI Index tracks, collates, distills, and visualizes data relating to artificial intelligence.

Global Securities Research (GSR) and Global Investment Strategy (GIS) are divisions of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Securities Research (GSR). Opinions represent GSR’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector, or the markets generally. GSR does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report. Past performance is no guarantee of future results.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold, or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs, and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable, but we make no guarantee to its accuracy or completeness.

Global Securities Research works with information received from various resources including, but not limited to, research from affiliated and unaffiliated research correspondents as well as other sources. Global Securities Research does not assign ratings to or project target prices for any of the securities mentioned in this report.

Global Securities Research receives research from affiliated and unaffiliated correspondent research providers with which Wells Fargo Investment Institute has an agreement to obtain research reports. Each correspondent research report reflects the different assumptions, opinions, and the methods of the analysts who prepare them. Any opinions, prices, or estimates contained in this report are as of the date of this publication and are subject to change without notice.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions, or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

©2024 Wells Fargo Investment Institute and subject to the CC BY-NC-ND 4.0 DEED. All rights reserved.

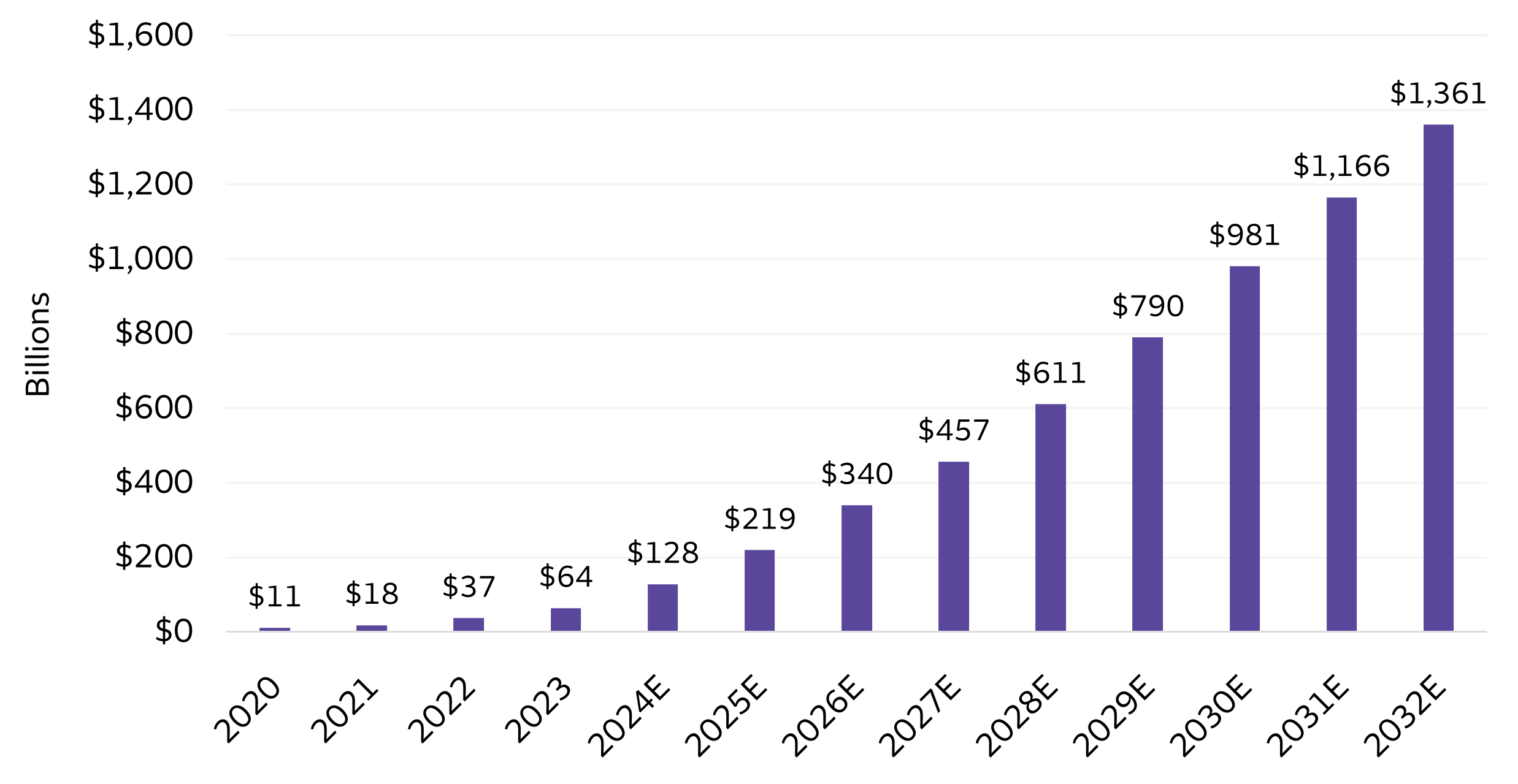

Sources: Wells Fargo Investment Institute, Bloomberg, and IDC. Data as of March 28, 2024. E = estimated. Estimates based on Bloomberg Intelligence forecasts using IDC, eMarketer and Statista data for the overall generative AI market.

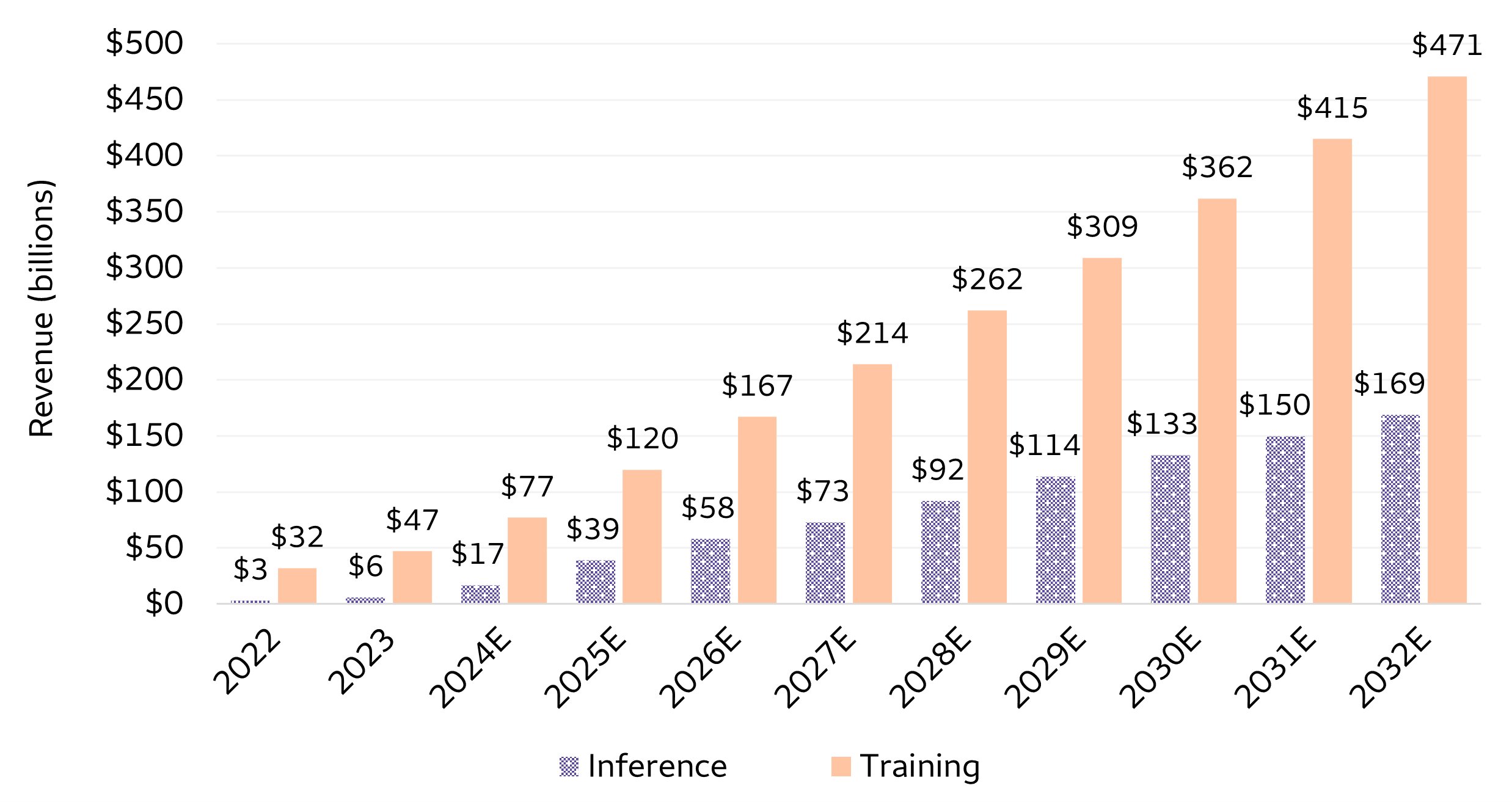

Sources: Wells Fargo Investment Institute, Bloomberg, and IDC. Data as of March 28, 2024. E = estimated. Estimates based on Bloomberg Intelligence forecasts using IDC, eMarketer and Statista data for the overall generative AI market. Sources: Wells Fargo Investment Institute, Bloomberg, and IDC. Data as of March 28, 2024. E = estimated. Estimates based on Bloomberg Intelligence forecasts using IDC data.

Sources: Wells Fargo Investment Institute, Bloomberg, and IDC. Data as of March 28, 2024. E = estimated. Estimates based on Bloomberg Intelligence forecasts using IDC data.