February 2025

Global Investment Strategy Team

Intro to digital assets — A short Q&A on the basics

Key takeaways

- Digital assets are part of a new platform that we anticipate could represent a new phase in the digital era.

What it may mean for investors

- We believe digital assets are investable as they continue to evolve.

This fourth installment in our four-part introductory series on digital assets uses a Q&A format to answer briefly the most common investor questions about what digital assets are, how they work, why interest is growing, common investor concerns, and how to invest. Other installments describe in detail what digital assets are and how they function, the investment rationale for digital assets, and why we believe it is neither too early nor too late to consider the investment opportunities we believe digital assets offer. We will periodically add to this series to support investor understanding of these assets.

What are digital assets?

Digital assets are items of value that can be securely owned, collected, traded, or invested in over the internet. They can be digitized items of value, such as photos, a will, a loan, or money. Digital assets also can be digitized claims on physical things, such as oil paintings and homes. Other digital assets can be securely exchanged over the internet as a means of payment, person to person, without the need for banks or governments to mediate. Bitcoin is the best known of this group, but there are many others. Digital-asset transactions and ownership are maintained on a digital ledger, called a blockchain. This ledger consists of blocks of transactions, grouped in a chain.

How have digital assets evolved?

Digital assets have resulted from technological innovations over decades, until bitcoin was created in 2009 and succeeded in attracting participants. Many follow-on digital assets began by copying bitcoin’s basic digital blueprints, although they differ from bitcoin and from each other in their structure.

What are some examples of how digital assets may be used?

We think more physical assets could be digitized.1 For example, future home buyers may receive a digital deed that the owner would hold in a private wallet. The municipality could also hold this deed and update it for liens on its own publicly viewable blockchain. A digital wallet segregates assets by ownership on an electronic ledger, called a blockchain, which secures ownership and transactions. The block is a collection of transactions, grouped in a chain. Transferring the digital deed likely would require the owner’s personal digital signature. This technology platform could transform other industries by virtue of its open and transparent platform that protects private information.

Other digital assets are not claims on other assets but are themselves assets that can gain or lose value. Today there are more than 10,000 active.2 Since bitcoin began in 2009, the industry market capitalization has grown to $3.5 trillion as of January 15. Bitcoin and Ethereum are the top two digital assets by market capitalization as of January 15 as well. These and other digital assets are exchangeable for dollars and have been used to buy goods. They have supplies that can be fixed (like bitcoin) or that increase only slowly over time. Thus, their utility, availability (also known as liquidity), and price trends exemplify factors that drive the assets’ demand and price.

What is the technology and how does it work?

The technology gives individuals the ability to securely store, control, and prove ownership over their personal digital assets without the help of a third party. The first key security feature is that removing a transaction from a blockchain can be exceedingly difficult. And for the most secure blockchains, like bitcoin, reversing a transaction is nearly impossible (we never say never when it comes to computer security).

Another security feature of the platform is that most blockchains are decentralized, which means that they are not held in one central location or controlled by one entity. Copies of the blockchain are spread across a global network of computers. Anyone interested can examine and scrutinize all transactions and even keep a copy.

Lastly, when a physical asset is digitally secured on the blockchain, it is wrapped in cryptography and stored in a personal digital wallet. Personal digital wallets are accessible from almost any digital device, but access requires a secret code, called a private key. Private keys are not the typical four- to six-digit passcodes that unlock a smartphone today. Private keys are typically 50 – 60 digits long, known only to the owner. Mathematically, guessing a private key of that length is the equivalent of winning the lottery nine times in a row.3

Are digital assets the same thing as money?

A digital asset that is itself a store of value, such as bitcoin, is a specific type of digital asset. Bitcoin and other digital assets can be exchanged and can gain or lose value as demand for them changes. Many digital assets have a price (which functions like an exchange rate with the U.S. dollar) and are similar to a currency in that sense. However, such exchangeable digital assets differ from the dollar in two key ways. First, the digital asset’s supply is either fixed or grows slowly, but the dollar’s supply is much more variable. Second, these exchangeable digital assets are traded privately. They are not owned by the government, nor do they require banks as go-betweens in exchange.

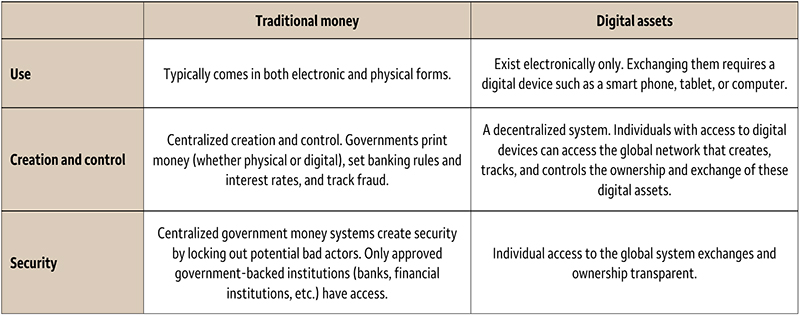

We believe the main differences between traditional money and digital assets are 1) use, 2) creation and control, and 3) security.

| Traditional money | Digital assets | |

|---|---|---|

| Use | Typically comes in both electronic and physical forms. | Exist electronically only. Exchanging them requires a digital device such as a smart phone, tablet, or computer. |

| Creation and control | Centralized creation and control. Governments print money (whether physical or digital), set banking rules and interest rates, and track fraud. | A decentralized system. Individuals with access to digital devices can access the global network that creates, tracks, and controls the ownership and exchange of these digital assets. |

| Security | Centralized government money systems create security by locking out potential bad actors. Only approved government-backed institutions (banks, financial institutions, etc.) have access. | Individual access to the global system exchanges and ownership transparent. |

Is bitcoin just like using a credit card or paying bills online?

No, these are different things. An individual who uses a U.S. credit card, pays a U.S. bill online, or uses other virtual payment methods is likely paying with U.S. dollars.

Can bitcoin replace the U.S. dollar?

We view this as unlikely. Bitcoin is exchangeable for other assets, including U.S. dollars, but is unlikely to replace the dollar. One reason is that bitcoin’s price swings up and down have been much greater than those of the dollar’s value against a basket of developed-market currencies.4 More generally, we see digital assets — similar as we see gold — as exchangeable stores of value. But neither seems feasible as the basis for a modern currency. To illustrate, consider that gold’s primary advantage as a potential currency may be its slow-growing supply, which serves to restrain consumer price inflation. That also appears to be its Achilles’ heel. Historically, this slow supply failed to keep up with demand for money, and in turn, restrained economic growth. This restraint became an intermittent political flashpoint through much of U.S. history, especially between 1890 and 1971, when the U.S. dropped its fixed exchange rate with gold. Bitcoin and some other digital assets that fix their supplies, or grow them only slowly, have the same disadvantage as currency contenders against the dollar.

Main investment risks we foresee

We can identify what we believe are the main risks.5

- Regulation. Additional regulation structure for such a young asset class can mean more transparency, which we believe will drive institutional interest and, potentially, performance.

- Volatility. Digital assets can generate significant ups and downs for a portfolio, particularly when they make up a larger share of the portfolio. Diversifying digital-asset exposure may help reduce portfolio volatility.6

- Accessibility. The complexity of the technology and the still-evolving regulatory environment are likely creating hesitation among investors, especially institutional investors.

- Valuation. This is a young asset class, and we do not yet see a consensus on how to measure fair value on digital assets. As more investors join this market, we believe volatility will fall further and make valuation more straightforward.

- Security. Some of the losses that investors have experienced came from an inadequate understanding of how to use the technology. Losses may also arise from investors’ reliance on intermediaries to buy, sell, and store their digital assets because the intermediary’s security may be less rigorous than the blockchain’s.7

How can one invest in digital assets?

There are thousands of digital coins (such as bitcoin and Ethereum) and tokens (such as Tether) that are not claims on other assets but can be stores of value in themselves. A singular feature of these coins and tokens is that the supplies of the more prominent assets tend to be fixed or expand slowly, thus providing some price support. However, the following are examples of factors that may drive demand — and hence price — at a particular moment.

- Utility. We foresee that wider use of digital assets in daily life (as described above) will help drive the utility of digital assets and, in turn, the investment demand for those assets that can be used in exchange or for investment. Different types of digital assets can also provide different utility to the end user. For example, coins are typically used as a medium of exchange or investment built on their own network. While tokens, are built on already existing networks, can act as a medium of exchange, and provide access to specific digital asset projects. Higher utility should drive demand and price higher.

- Regulatory structure. This is a developing and important factor that can restrict how digital assets may be used and exchanged (and thus influence utility).

- Liquidity. This refers to how efficiently digital assets may be transacted. Low liquidity suggests that a buyer may have to pay more for a scarce digital asset with limited sellers, or that a seller may have to consider accepting a lower price, due to a lack of buyers.

Spot-based bitcoin exchange-traded funds (ETFs), for clarity, provide investors direct exposure to bitcoin’s price movements, but they do not provide direct ownership of bitcoin. Direct ownership always resides with the entity that holds the private keys to bitcoin, which in this case is the ETF provider. When an investor buys bitcoin through a spot ETF, the fund holds the bitcoin on behalf of the investor, securing it with an outside custodian. The investor does not hold the digital asset directly but receives a number of ETF shares consistent with the share of the fund’s assets.

Summary

We view digital assets as very likely to become tools for everyday economic needs and potentially even a payments system that extends around the world. Digital assets are likely to change the ways people use the internet to make transactions, secure personal data, and even run a business. Bitcoin and other digital assets have potential as investments with a goal to increase value. The utility and the appeal of the security features in these technologies help justify digital assets as an investable asset class that should continue to drive investor interest. While we do foresee the adoption of digital assets growing, its important to understand that digital assets are often more volatile than traditional asset classes, and the regulatory landscape remains uncertain. Any decisions should start with an understanding of the opportunities as well as the risks.

Our Wells Fargo Investment Institute introductory series on digital assets:

Intro to digital assets — What they are, what they do

Intro to digital assets — The investment rationale

Intro to digital assets — Too early or too late to invest?

Intro to digital assets — A short Q&A on the basics

1 For more details on what digital assets are, their security features, and their uses, please see our report, “Intro to digital assets — What they are, what they do ,” February 2025.

2 Raynor De Best, “Number of digital assets worldwide from 2013 to December 2024,” Statista, December 9, 2024.

3 Aaron Hankin, “The chance of hacking a bitcoin wallet is as likely as winning Powerball – 9 times in a row,” CryptoWatch by MarketWatch, March 6, 2018.

4 Using standard deviation to measure price volatility and calculating that measure over the period from July 17, 2010, to December 12, 2024, for both the Bloomberg Galaxy Bitcoin Index and the U.S. dollar’s weighted-average exchange value relative to a basket of U.S. trade partner currencies, composed of the euro, Japanese yen, pound sterling, Canadian dollar, Swedish krona, and Swiss franc.

5 We explain these risks in more detail in our report, “Intro to digital assets — What they are, what they do,” February 2025.

6 For a more detailed discussion of digital assets in diversification, please see our report “Intro to digital assets — The investment rationale,” February 2025.

7 The exchanges assist individuals in transacting digital assets but tend to have inferior security compared to a blockchain. Hence, the large number of breaches is associated with exchanges. See, for example, ”These are the largest cyber thefts of the past decade – and 80% of them involve Bitcoin,” Fortune, April 6, 2021. Alternatively, see “Cloud Security Alliance Releases Guidance for Crypto-Asset Exchange Security,” Businesswire, April 13, 2021.

Risks Considerations

Virtual or cryptocurrency is not a physical currency, nor is it legal tender. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. An investor could lose all or a substantial portion of his/her investment. Cryptocurrency has limited operating history or performance. Fees and expenses associated with a cryptocurrency investment may be substantial. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies.

Digital currency also known as crypto currency or bitcoin, as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Digital assets may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers. Investments in equity securities are generally more volatile than other types of securities.

Investments in gold and gold-related investments tend to be more volatile than investments in traditional equity or debt securities. Such investments increase their vulnerability to international economic, monetary and political developments.

Exchange-traded funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed, or sold, may be worth more or less than their original cost. ETFs seek investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price and yield performance of the index can be fully matched.

Definitions

Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

An index is unmanaged and not available for direct investment.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.