February 2025

Global Investment Strategy Team

Intro to digital assets — Too early or too late to invest?

Key takeaways

- Digital assets appear to be gaining adoption rapidly, similar to the path of internet adoption during the mid-to-late 1990s.

- Many digital-asset prices have grown globally and rapidly off a low price basis.

What it may mean for investors

- We believe digital assets are investable as they continue to evolve.

This is the third in a four-part introductory series on digital assets. This installment notes the rapid increase in digital-asset adoption and in prices, though it is still early in the investment evolution of digital assets. The focus of this installment is our belief that it is neither too early nor too late to invest in digital assets. Other reports in our series explain in more detail what digital assets are and why we believe they are investable. A fourth report uses a Q&A format to answer briefly some of the questions we see most often from investors about digital assets. We will periodically add to this series, to support investor understanding of these assets.

The “too late to invest” argument

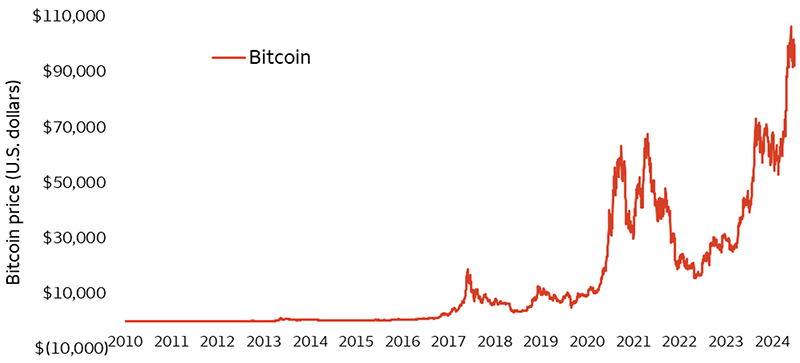

As a reminder, digital assets are broadly defined as items of value that can be securely owned, collected, traded, or invested in over the internet. They can represent things that can be digitized such as photos, a will, a loan, or money, and they can also be claims on physical things, such as oil paintings and homes.1 They also can be assets that people can exchange between themselves, as a means of payment or as an investment. As an example, bitcoin falls within this latter group, and the recent price surge (Chart 1) has prompted questions about whether it may be too late to invest.

Sources: Bloomberg and Wells Fargo Investment Institute. Daily data from July 19, 2010, to January 15, 2025.. Bitcoin returns since July 2010 — cumulative return of 124598525% and annualized return of 163%. Past performance does not guarantee future results.

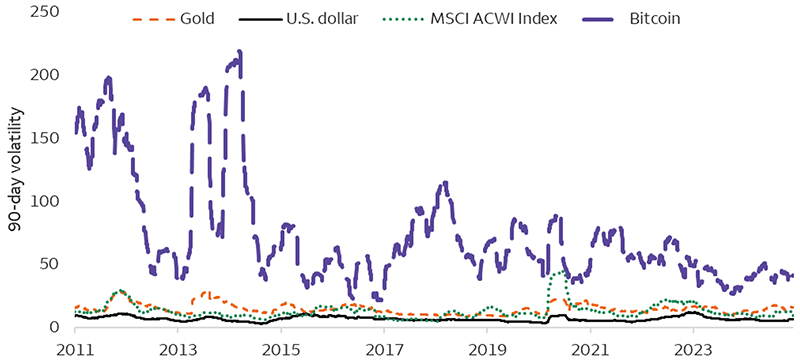

Sources: Bloomberg and Wells Fargo Investment Institute. Daily data from July 19, 2010, to January 15, 2025.. Bitcoin returns since July 2010 — cumulative return of 124598525% and annualized return of 163%. Past performance does not guarantee future results.We believe that focusing too much on past performance in this new industry can mislead new investors. First, digital assets are still a young investment space, and percentage price gains are skewed because most digital assets evolved from virtually zero. The vast majority are less than seven years old.2 Bitcoin only dates from 2009, and its first real-world transaction did not occur until May 2010, 16 months after its creation. This transaction valued one bitcoin at roughly $0.004, and that price did not cross $1 until February 2011.3 Price volatility is common in assets that are young. For example, bitcoin is the oldest and arguably one of the least volatile digital assets, but it is still roughly three times more volatile than the price of gold and a basket of global equities (Chart 2).

Sources: Bloomberg and Wells Fargo Investment Institute. Daily data from January 3, 2011, to January 15, 2025. Volatility is measured as a 90-day standard deviation of price. Gold spot price per troy ounce. Standard Deviation is a statistical measure of the volatility of returns. The higher the standard deviation, the greater volatility has been. An index is unmanaged and not available for direct investment. Past performance does not guarantee future results.

Sources: Bloomberg and Wells Fargo Investment Institute. Daily data from January 3, 2011, to January 15, 2025. Volatility is measured as a 90-day standard deviation of price. Gold spot price per troy ounce. Standard Deviation is a statistical measure of the volatility of returns. The higher the standard deviation, the greater volatility has been. An index is unmanaged and not available for direct investment. Past performance does not guarantee future results.Second, we believe that some of the volatility in Chart 2 derives from the technological complexity involved in creating the digital asset and because digital assets trade over the internet, outside the traditional financial system. We think this feature has discouraged investment flows and research coverage. By contrast, companies in the traditional financial system develop with private investment in order to attract public investors. If financially successful, these companies may look for broad research coverage and access to large pools of investors.

Why we believe it is early, but not too early

We see digital assets in the “early, but not too early” investment stage. Global digital-adoption rates have quickly accelerated from a low base and appear to be tracking a pattern similar to other technologies, such as the internet. The balance of this report discusses why we believe that digital assets may be near an adoption inflection point that could track the development of other disruptive technologies during the past century-plus.

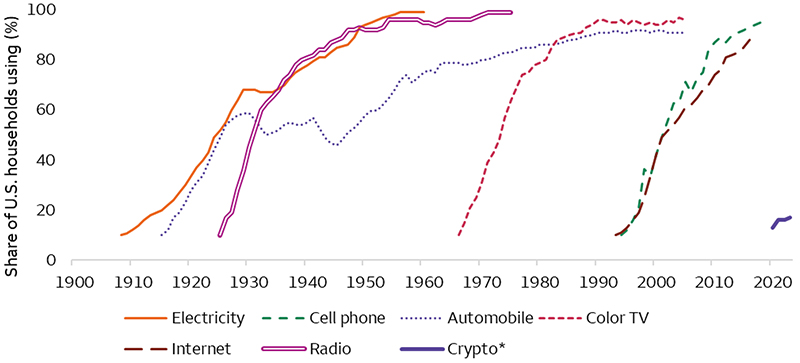

Chart 3 highlights the adoption paths by U.S. households of select technologies that were new for their time. The rising lines look much like an “S” in that adoption typically started slowly, hit an inflection point, and then steeply accelerated. As an example, the internet was invented in 1983, yet by 1995, only 9.2% of Americans (and less than 1% of the world) were using it.4 We view the internet adoption pattern as similar today for digital assets. The latest Pew Research survey showed that 17% of Americans purchased or traded digital assets in 2023 (Chart 3).5

Sources: Our World in Data, National Opinion Research Center (NORC), and Wells Fargo Investment Institute. Yearly data from 1900 to 2023. * Digital-asset share figure based on results from survey conducted by NORC at the University of Chicago.

Sources: Our World in Data, National Opinion Research Center (NORC), and Wells Fargo Investment Institute. Yearly data from 1900 to 2023. * Digital-asset share figure based on results from survey conducted by NORC at the University of Chicago.User experiences with new technologies can be difficult while the infrastructure slowly matures. Many readers may remember when accessing the internet required typing at a prompt on a green screen, before the first web browser in 1993.6 And, when the first-use cases do emerge, consumers still need time to figure out what the technology is, what it can do, and how it can benefit them. That is the subject of our first report in this series.7

Our view: Digital-asset adoption today looks similar to 1990s internet

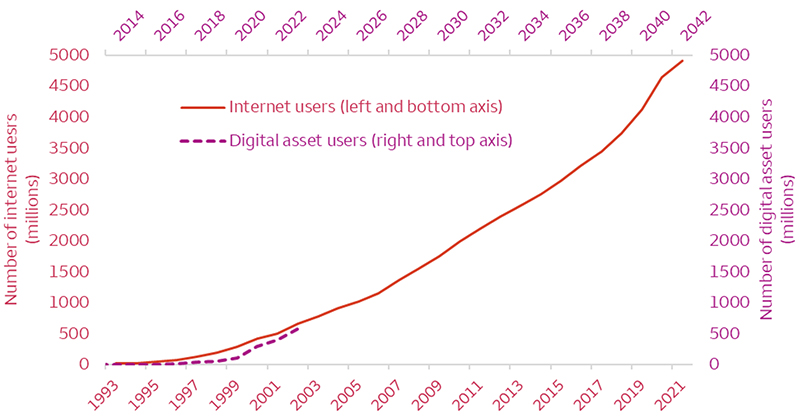

The technology behind digital assets is complex, and use cases can be hard to visualize for those new to the space, but the world is beginning to embrace the technology — and quickly. Back in 2021, it took only four months to double the global digital-asset user population from 100 million to 200 million.8 As of 2023, the number of global digital-asset users reached 575 million, or roughly 7% of the world’s population.9

If this trend continues, digital assets could soon exit the early adoption phase and inflect higher, similar to other technologies seen in Chart 3. For the internet, that point was the mid-1990s. After a slow start in the early 1990s, internet use surged from 77 million in 1996 to 412 million in 2000. By 2010, worldwide internet use had grown to 1.98 billion, and today it sits at 5.4 billion.10

Once internet adoption inflected higher in the mid-1990s, usage rose at a faster rate than the other advanced technologies. Its line in Chart 3 is straighter and less S-shaped than the adoption pace for older technologies, such as electricity and the radio. Cell phone adoption also shows a similar trajectory. It is likely that each new digital invention rides the coattails of the digital infrastructure already built. We expect that digital assets eventually will follow an accelerated adoption path, similar to recent digital inventions.

Chart 4 helps visualize why we believe that digital assets may be close to an adoption inflection point. The chart compares global user growth between the internet, starting in 1993, and digital asset users, starting in 2014. From this comparison, it appears that digital-asset use today may even be a little ahead of the mid-1990s internet. Global digital-asset adoption is clearly rising and could soon hit an inflection point.

Recent regulatory progress also supports accelerating adoption. As we have discussed in other reports in this series, digital assets’ maturation has prompted legal and oversight frameworks to solidify them as investable assets.11 We believe that a still-emerging regulatory structure is an important roadblock to be removed, as it was cited as a main impediment to investment by 2024 Bitwise/VettaFi survey of advisor’s sentiment toward digital-asset investing.12

Sources: International Telecommunication Union, Our World in Data, Crypto.com, Statista, Bloomberg, and Wells Fargo Investment Institute. Annual data from 1993 to 2023.

Sources: International Telecommunication Union, Our World in Data, Crypto.com, Statista, Bloomberg, and Wells Fargo Investment Institute. Annual data from 1993 to 2023.What we favor doing now

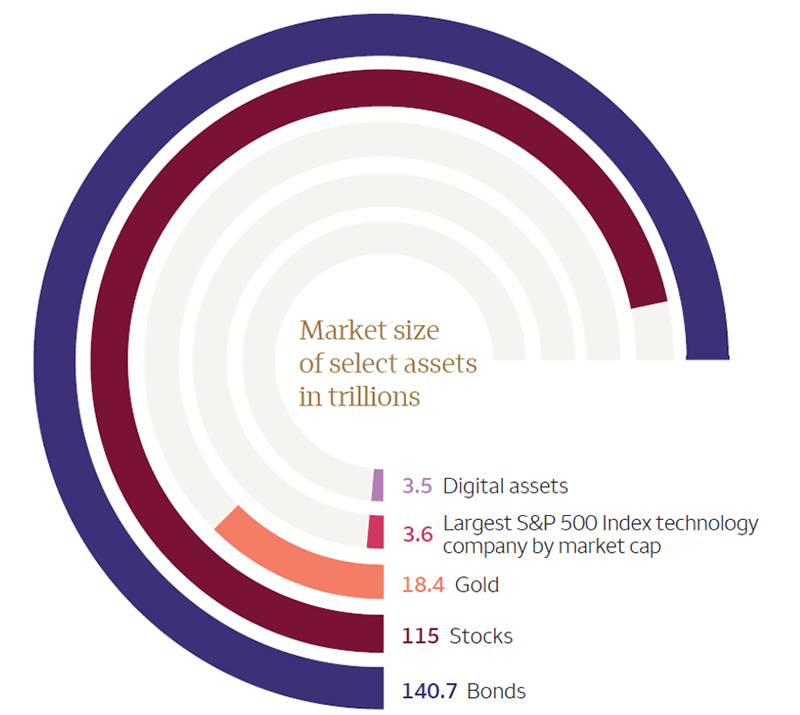

Patience. We think most of the opportunity lies ahead, not behind. Chart 5 highlights that the entire market capitalization of digital assets remains less than that of the largest S&P 500 technology company by market cap, Apple Inc.

Sources: Bloomberg, Securities Industry and Financial Markets Association, Bank of International Settlements, CoinMarketCap, Prices (George Warren and Frank Pearson), U.S. Geological Survey, Metal Focus Data, and Wells Fargo Investment Institute. Digital assets and Apple Inc. market cap size as of January 15, 2025. Bond and stock market size as of December 31, 2023. Gold market size calculated by multiplying estimated amount of troy ounces of gold ever mined as of December 31, 2023 data by the price of gold as of January 15, 2025. An index is unmanaged and not available for direct investment.

Sources: Bloomberg, Securities Industry and Financial Markets Association, Bank of International Settlements, CoinMarketCap, Prices (George Warren and Frank Pearson), U.S. Geological Survey, Metal Focus Data, and Wells Fargo Investment Institute. Digital assets and Apple Inc. market cap size as of January 15, 2025. Bond and stock market size as of December 31, 2023. Gold market size calculated by multiplying estimated amount of troy ounces of gold ever mined as of December 31, 2023 data by the price of gold as of January 15, 2025. An index is unmanaged and not available for direct investment.Prudence. Digital-asset adoption rates are rising, but investment options are still maturing. There are different ways to gain exposure today: 1) buying digital assets directly from a digital asset exchange, and 2) mutual funds, exchange-traded funds (ETFs), and grantor trusts. As to Option 1, buying directly from an exchange — we do not recommend this as the technology remains complex, and securing one’s digital assets can be difficult and risky. Meanwhile, we believe option 2 is becoming a viable option for investors to gain exposure in the U.S. as the U.S. Securities and Exchange Commission approved the first set of spot-based bitcoin ETFs in January 2024.13

Caution. Early stage investing is often fraught with volatility, and can be extreme. Over time, we expect leaders to emerge, while others fail. Digital assets already succumbed to one major shakeout event in 2018, when the market capitalization of all digital assets listed on CoinMarketCap’s database fell by more than 80% between January and December. This was followed by two other shakeout events in 2021 and 2023, which dropped the total market capitalization of digital assets 73% from the early 2021 peak. Odds are high that digital assets will see future shakeout events.

Lastly, picking long-term technology winners is challenging. Investors must routinely evaluate the current winners and losers against the ever-rising set of yet-to-be-created companies. We will use 1996 – 1997 as an example again. In 1996, the most visited web pages were AOL’s webcrawler, Netscape, Compuserve, and Prodigy, and the first social media site, myspace, was launched.14 None of these remained relevant long term. About this time, the yet-to-be-created long-term winners started to emerge such as Google LLC, Amazon.com Inc., Netflix Inc., and Meta Platforms Inc. And if the landscape was not complicated enough, one of the greatest losers of that time based on market capitalization, Apple Inc., survived to become the largest company by market capitalization in the U.S.

Summary

For today’s investor trying to figure out if they are early or late to digital-asset investing, looking to technology investing in the mid-to-late 1990s for time to adaptation to main stream seems reasonable. Digital-asset investment options today, however, are still maturing, and we advise patience. Please contact a financial advisor for further information.

Our Wells Fargo Investment Institute introductory series on digital assets:

Intro to digital assets — What they are, what they do

Intro to digital assets — The investment rationale

Intro to digital assets — Too early or too late to invest?

Intro to digital assets — A short Q&A on the basics

1 For more details on the definition, types, and uses of digital assets, please see our report, “Intro to digital assets — What they are, what they do,” February 2025.

2 Raynor De Best, “Number of digital assets worldwide from 2013 to December 2024,” Statista, December 9, 2024.

3 Ofir Beigel, Bitcoin Historical Price & Events, 99Bitcoins, January 3, 2021.

4 “Share of the population using the internet”. Our World in Data website,” Internet World Stats website, 2023

5 “2024 pew research center’s American trends panel wave 142 internet topline” (February 2024). Pew Research Center.

6 Mike Murphy, “From dial-up to 5-G: a complete guide to logging on to the internet,” Quartz, October 29, 2019.

7 That report is titled “Intro to digital assets — What they are, what they do,” February 2025.

8 Kevin Wang, “Measuring Global Crypto Users,” Crypto.com, July 2021.

9 Raynor de Best, “Number of identity verified cryptoasset users from 2016 to June 2024,” Statista, August 21, 2024.

10 “Worldwide Digital Population 2024”, Statista, July 2024.

11 For more on the rapidly developing market and regulatory infrastructure, please see our report, “Intro to digital assets — The investment rationale,” February 2025.

12 Matt Hougan, Juan Leon, and Todd Rosenbluth, “Bitwise/VettaFi 2024 benchmark survey of financial advisor attitudes toward crypto assets,” Bitwise, January 4, 2024.

13 For more on investment options, please see our report, “Intro to digital assets — The investment rationale,” February 2025.

14 Farhad Manjoo, “Jurassic Web: The Internet of 1996 is almost unrecognizable compared with what we have today,” The Slate Group website, February 24, 2009.

Risks Considerations

Virtual or cryptocurrency is not a physical currency, nor is it legal tender. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. An investor could lose all or a substantial portion of his/her investment. Cryptocurrency has limited operating history or performance. Fees and expenses associated with a cryptocurrency investment may be substantial. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies.

Digital currency also known as crypto currency or bitcoin, as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Digital assets may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers. Investments in equity securities are generally more volatile than other types of securities.

Investments in gold and gold-related investments tend to be more volatile than investments in traditional equity or debt securities. Such investments increase their vulnerability to international economic, monetary and political developments.

Investments in fixed-income securities are subject to interest rate, credit/default, liquidity, inflation and other risks. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. Credit risk is the risk that an issuer will default on payments of interest and principal. This risk is higher when investing in high yield bonds, also known as junk bonds, which have lower ratings and are subject to greater volatility. If sold prior to maturity, fixed income securities are subject to market risk. All fixed income investments may be worth less than their original cost upon redemption or maturity.

Exchange-traded funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed, or sold, may be worth more or less than their original cost. ETFs seek investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price and yield performance of the index can be fully matched.

Definitions

S&P 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks that is generally considered representative of the US stock market.

MSCI All Country World Index (MSCI ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed and 26 emerging markets.

An index is unmanaged and not available for direct investment.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.