February 2025

Global Investment Strategy Team

Intro to digital assets — The investment rationale

Key takeaways

- Improved regulatory clarity and rising interest in digital technologies have accompanied a wider variety of digital assets and an increased market capitalization.

- Risks remain, yet we view digital assets as an emerging asset class while market depth and breadth continue to improve.

What it may mean for investors

- We believe digital assets are investable as they continue to evolve.

This second installment in our four-part introductory series on digital assets discusses our view that improved regulatory clarity, as well as improved market depth and breadth, make digital assets a viable investment asset. Other reports discuss what digital assets are and what they do as well as why we think it is neither too early nor too late to invest. A final installment uses a Q&A format to provide brief answers to basic questions that investors ask about digital assets. We will periodically add to this series, to support investor understanding of these assets.

Executive summary — What has changed, and why now?

We believe that digital assets have evolved into a viable investment asset. There are over 10,000 digital assets with a market capitalization of $3.5 trillion (as of January 15, 2025), and this depth and breadth allow additional analysis of their trends.1 Short-term factors suggest further deepening of the market. We believe long-term supply and demand trends support further industry growth, the potential for further compression in price volatility, and a possible role as portfolio diversifiers.

Several significant events since 2020 — many of these in 2024 — have accelerated the maturation of digital-asset markets. Notably, banks gained regulatory permission to custody digital assets, and the investment industry and regulators took additional steps to extend a legal and oversight framework that should help solidify these as investable assets. In particular, the Securities and Exchange Commission (SEC) has allowed a number of exchange-traded funds (ETFs) based on futures- and spot-market digital-asset prices.

Evolving markets for investable assets often introduce unique risks that require deeper due diligence. Known digital-asset risks include the possibility of additional regulation and various operational risks associated with making transactions. Some periods of persistently high volatility remain likely as the market evolves. These potential risks highlight the need for educational reports and investor due diligence.

We classify digital assets as part of real assets within an asset-allocation framework. Bitcoin, the largest digital asset by market capitalization and the one with the most investment product availability, has been classified by regulatory authorities as a commodity.2 We agree with that asset-class taxonomy.

Brief background on the evolution of digital assets and blockchain technologies

As we describe in the first report in this series, digital assets are items of value that can be collected, traded, or invested in over the internet. They can represent things that can be digitized, such as photos, and can be digitized claims on physical things, such as oil paintings and homes. Converting a house deed into a digital asset is done by creating a digital version of the deed, which is called a token. The token is then stored electronically on a digital ledger, called a blockchain, which tracks ownership and transactions.3

A digital asset that that can be exchanged as a method of payment is a specific type of digital asset. Bitcoin and other digital assets cap their supplies, but their value can rise and fall with demand.4 Further, because they can hold value and are exchangeable at a publicly known price, they are available to households and businesses as a means of exchange or payment for a range of goods, services, and digital assets, as described in the previous paragraph. In turn, we foresee that this utility could create additional demand for investable digital assets as investments.

A key feature of these investable digital assets is that their supply is independent of Federal Reserve and other central-bank monetary policy. Another difference with government-issued currencies is that these digital assets are created, stored, and tracked on decentralized digital ledgers, called blockchains. Removing a transaction from a decentralized blockchain can be exceedingly difficult. For the most secure blockchains, like bitcoin, reversing a transaction can be nearly impossible (we never say never when it comes to computer security).

Digital assets as an investable asset

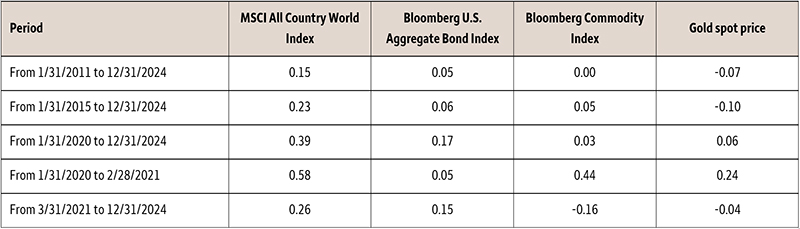

Digital assets, in our view, have now evolved into a valid consideration as a portfolio option for qualified investors. Most digital assets do not pay interest or dividends, and there are no expected earnings to inform today’s prices.5 One sign of stability is that digital assets appear to be developing fundamental short- and long-term price drivers. Low five- and ten-year correlations with traditional asset-class returns over longer and most shorter time horizons (Table 1) suggest different digital-asset prices compared to traditional investment-asset prices. In this way, digital assets are potential portfolio diversifiers, which we believe adds to the stability and viability of these assets.

| Period | MSCI All Country World Index | Bloomberg U.S. Aggregate Bond Index | Bloomberg Commodity Index | Gold spot price |

|---|---|---|---|---|

| From 1/31/2011 to 12/31/2024 | 0.15 | 0.05 | 0.00 | -0.07 |

| From 1/31/2015 to 12/31/2024 | 0.23 | 0.06 | 0.05 | -0.10 |

| From 1/31/2020 to 12/31/2024 | 0.39 | 0.17 | 0.03 | 0.06 |

| From 1/31/2020 to 2/28/2021 | 0.58 | 0.05 | 0.44 | 0.24 |

| From 3/31/2021 to 12/31/2024 | 0.26 | 0.15 | -0.16 | -0.04 |

The correlations in Table 1 show episodes when macroeconomic and financial conditions (such as the pandemic) temporarily drive both digital-asset prices and other asset prices. Notably, the correlation between a digital-asset price composite and the MSCI All Country World Index, a benchmark index for global equity prices, increased sharply during the period from January 31, 2020, to February 28, 2021. The composite’s correlation with a commodity benchmark index was also significant. But in the subsequent, most recent period, the correlations reverted to the low levels of earlier periods. Outside research tends to align with these findings.6

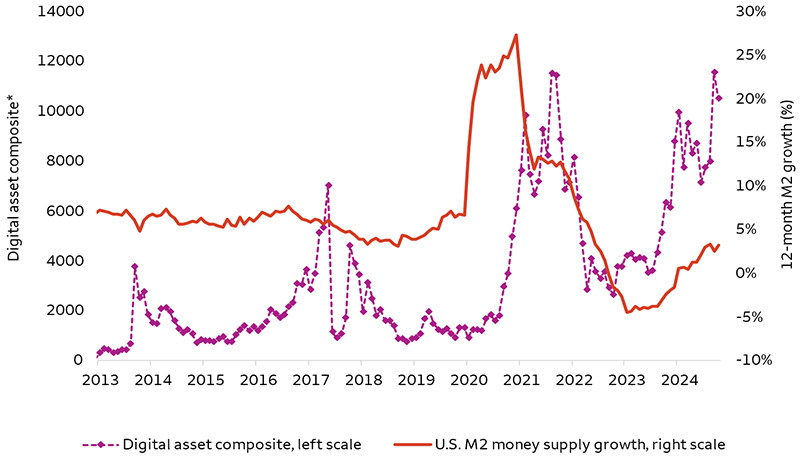

The pandemic-related increase in correlation is likely the result of the 2020 – 2021 money-supply surge (Chart 1, below). Money growth between 2020 and 2021was the fastest since 1981 and came with dramatically lower interest rates, which we believe increased the demand for equities and digital assets as an alternative to low fixed-income yields. Extreme money-supply growth has historically raised inflation fears and worries about eventual dollar debasement. In fact, some research in 2021 found a sharp rise in media reports that mentioned both digital assets and consumer price inflation.7 However, 12-month money-supply growth declined sharply after 2021, and the 2.5% rate as of November 2024 was far below its January 1980 – October 2024 average pace of 6.3%.

In sum, environmental factors (such as the pandemic) or policy factors (such as above-average money supply growth) may elevate short-term correlations between digital assets and traditional investment assets. Nevertheless, their persistently low correlations over five- and ten-year horizons suggest that the diverse factors specific or idiosyncratic to digital-asset returns differentiate these assets from traditional assets. Looking ahead, we expect that the market for digital assets will continue to develop from separate and unique factors, as we discuss on the following pages.

Sources: Bloomberg and Wells Fargo Investment Institute. Monthly data from March 31, 2013, to December 31 2024. *Indexed to 1 as of December 31, 2010. M2 is a measure of the U.S. money supply that includes cash, checking deposits, small-time deposits, and most money market funds. Digital-asset prices are represented by the same composite used to calculate the correlations in Table 1. Please see the note to that table for an explanation of the construction of that composite. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results.

Sources: Bloomberg and Wells Fargo Investment Institute. Monthly data from March 31, 2013, to December 31 2024. *Indexed to 1 as of December 31, 2010. M2 is a measure of the U.S. money supply that includes cash, checking deposits, small-time deposits, and most money market funds. Digital-asset prices are represented by the same composite used to calculate the correlations in Table 1. Please see the note to that table for an explanation of the construction of that composite. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results.We view long-term digital-asset supply and demand as the main factors to help build stability. Fixed or slow-growing supply characterizes most digital assets (as an example, see footnote 4). We believe potential demand growth for digital assets is just as important as the supply constraints. The disruptive potential of decentralized systems could be large across the economy. An entire system of such applications is already developing to provide financial services — from trading to lending to custody. For example, these new digital applications do not have to pass through payer and payee banks, which increases accessibility and reduces processing costs.8 Additionally, transaction validation by multiple participants on the blockchain adds transparency. Even new decentralized stock and digital coin exchanges are emerging. Moreover, a growing group of blockchains offers “smart contracts”, which are essentially legal contracts that execute automatically when specific conditions are met. Digital applications such as these could extend soon into healthcare, insurance, and supply chain management, to name only a few.

Digital assets and artificial intelligence (AI) are emerging as the newest technologies to push the bounds of doing various kinds of business digitally. AI refers to developing computers to perform tasks that normally require human intelligence. The Information Technology and Communication Services sectors have led in adopting artificial intelligence, especially in using natural language systems to take customer calls.9 The same research shows automotive and other assembly industries close behind, with robots on assembly lines, while the Utilities, Financials and Health Care sectors are advancing, but from the rear.

Digital assets complement the rise of artificial intelligence by connecting payment systems to the broader automation trend. For example, a computer may monitor the status of machines and soap dispensers at a laundromat, but adding a digital asset-based payment system would allow the computer to order and pay for soap deliveries as well. In sum, we believe the trends point toward more automation, and digital payment systems should further increase the prospect for lowering business operating costs.

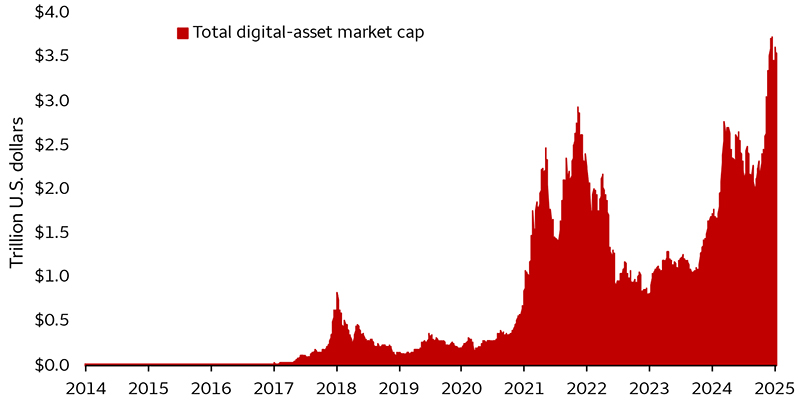

Growing interest during the past 11 years has brought more digital assets, larger market capitalization, and gradually improving consistency in digital asset prices (Chart 2).

Sources: CoinMarketCap, Wells Fargo Investment Institute. Daily data: January 31, 2014 – January 15, 2025. The total digital market capitalization includes all digital assets found on CoinMarketCap’s database. This is not limited to cryptocurrencies, but includes all forms of digital assets, such as stablecoins and tokens.

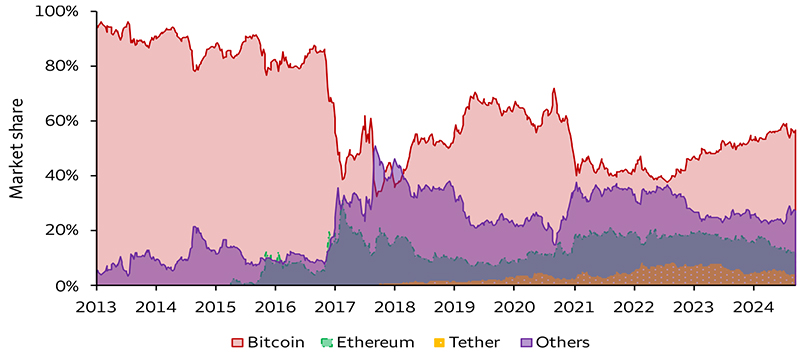

Sources: CoinMarketCap, Wells Fargo Investment Institute. Daily data: January 31, 2014 – January 15, 2025. The total digital market capitalization includes all digital assets found on CoinMarketCap’s database. This is not limited to cryptocurrencies, but includes all forms of digital assets, such as stablecoins and tokens.At the same time, the market has developed a growing diversity, represented by the increasing share of market capitalization among other digital coins (Chart 3).

Sources: CoinMarketCap, Wells Fargo Investment Institute. Weekly data: May 4, 2013 – January 12, 2025. The other category includes all other digital assets, excluding Bitcoin, Ethereum, and Tether in CoinMarketCap’s database. This is inclusive of all digital assets, including stablecoins and tokens.

Sources: CoinMarketCap, Wells Fargo Investment Institute. Weekly data: May 4, 2013 – January 12, 2025. The other category includes all other digital assets, excluding Bitcoin, Ethereum, and Tether in CoinMarketCap’s database. This is inclusive of all digital assets, including stablecoins and tokens.Investments in a greater variety of digital assets should imply a decreasing percentage of investors who buy or sell on any given news, which, in turn, should reduce price volatility. It has already. The annualized volatility in a digital asset index was 277% between January 2011 and January 2016, but it more than halved to 79% over the past five years (December 2019 and December 2024).10 We also calculated correlations between digital assets based on monthly price returns. The same data over the past five years also showed high correlations between pairs of digital assets, particularly among those with the largest market capitalizations, indicating that the rising number of digital assets may reduce the idiosyncratic risks of holding any small subset.11

Main investment risks we foresee

We can identify what we believe are the main risks.12

- Regulation. Additional regulation structure for such a young asset class can mean more transparency, which we believe will drive institutional interest and, potentially, performance.

- Volatility. Digital assets can generate significant ups and downs for a portfolio, the larger their portfolio share. Diversifying digital asset exposure may help reduce portfolio volatility, as suggested in Table 1 and studied in more depth in the research of others.13

- Accessibility. The complexity of the technology and the still-evolving regulatory environment are likely creating hesitation among investors, especially institutional investors.

- Valuation. This is a young asset class, and we do not yet see a consensus on how to measure fair value on digital assets. As more investors join this market, we believe volatility will fall further and make valuation more straightforward.

- Security. Some of the losses that investors have experienced come from inadequate understanding of how to use the technology. In addition, reliance on intermediaries to buy, sell, and store investors’ digital assets, because the intermediary’s security may be less rigorous than the blockchain’s.14

Parameters for investing in digital assets

There are thousands of digital coins (such as bitcoin and Ethereum) and tokens (such as Tether) that are not claims on other assets but can be stores of value in themselves. A singular feature of these coins and tokens is that the supplies of the more prominent assets tend to be fixed or expand slowly, thus providing some price support. However, the following are examples of factors that may drive demand – and hence price – at a particular moment.

- Utility: We foresee that wider use of digital assets as described above in daily life will help drive the utility of digital assets and, in turn, the investment demand for those assets that can be used in exchange or for investment. Higher utility should drive demand and price higher. As new coins emerge, some can compete better with established coins.

- Regulatory structure is a developing and important factor that can restrict how coins may be used and exchanged (and thus influence utility).

- Liquidity refers to how efficiently a coin or token may be transacted. Low liquidity suggests a buyer may have to pay more for a scarce coin, or that a seller may have to consider how many coins to offer before driving down the price.

Spot-based bitcoin ETFs, for clarity, provide investors direct exposure to bitcoin’s price movements, but not direct ownership of bitcoin. Direct ownership always resides with the entity that holds the private keys to bitcoin, which in this case is the ETF provider. When an investor buys bitcoin through a spot ETF, the fund holds the bitcoin on behalf of the investor, securing it with an outside custodian. The investor does not hold the digital asset directly but receives a number of ETF shares consistent with the share of the fund’s assets. We expect more ways to invest as the industry and investors come to understand better the trends toward digitization in economic activity and the demand for digital assets and blockchain technologies.

Summary

Improved regulatory clarity and rising interest in digital technologies have accompanied a wider variety of digital asset and increased market capitalization. We believe digital assets should show more viability and durability over time as investable assets. Bouts of rising volatility could persist, but, in our view, the evidence of their greater stability and long-term diversification potential together point to a viable investment asset for exposure in portfolios in a controlled way. Our series of reports dives deeper into all aspects of digital assets.

Our Wells Fargo Investment Institute introductory series on digital assets:

Intro to digital assets — What they are, what they do

Intro to digital assets — The investment rationale

Intro to digital assets — Too early or too late to invest?

Intro to digital assets — A short Q&A on the basics

1 CoinMarketCap, December 11, 2024. Raynor De Best, “Number of cryptocurrencies worldwide from 2013 to December 2024,” Statista, December 9, 2024.

2 Alternative investments share some characteristics with digital assets such as non-traditional sources of return, potential long-term diversification, complexity, potential illiquidity premiums, and higher volatility.

3 As we explain in our first report in the series, “Intro to digital assets — What they are, what they do,” Cryptography helps secure transactions between two parties and proves asset ownership. Moving a digital asset requires lengthy cryptographic passcodes, which, for security purposes, can be longer than most internet passwords. These functions work together to help digital assets establish investor trust and gain value.

4 As an illustration, bitcoin’s hard-coded protocol fixes the supply cap at 21 million but with a diminishing supply growth over time. About every four years, the bitcoin reward that a miner gets for validating transactions and creating the next block in the chain gets cut in half. At bitcoin’s beginning in 2009, miners were rewarded 50 bitcoin with the right to produce the next block. In 2012, that reward dropped to 25 bitcoin reward per block. The rate halved again in 2016 to 12.5, and in May 2020 to 6.25 (according to Blockchain.com, "Total Circulating Bitcoin," and CoinMarketCap, "Bitcoin Halving Countdown.") Also according to CoinMarketCap, through April 23, 2021, about 18.7 million of the 21 million have been mined. Thus, the total is fixed but supply grows asymptotically slower over time.

5 Some digital assets do pay what is called a staking yield. Some blockchains attempt to attract investors to buy and hold coins on their blockchain. Doing so helps validate the security of the blockchain for other users. In return the owner of the coins receives a share of the network’s profits, expressed as an annual percentage yield.

6 D. V. Wijk, “What can be expected from the Bitcoin?” Erasmus Universiteit Rotterdam, 2013. Also see Aiman Harudin, Azhar Mohamad, Imtiaz Sifat, and Yusniliyana Yusof, “Cryptocurrencies: A Survey on Acceptance, Governance and Market Dynamics,” International Journal of Finance & Economics, December 14, 2020.

7 See, for example, Ronnie Sadka, Travis Whitmore, Gideon Ozik, Rajeev Bargava, and Zach Crowell, “Thematic Indicators: New Bitcoin Indicator Offering,” State Street Associates Global Markets, April 12, 2021. Also see J. Asplund and F. Ivarsson, “What drives the price development of cryptocurrencies?” University of Gothenburg, 2018.

8 Rakesh Sharma, “What is decentralized finance and how does it work?” Investopedia, October 15, 2024.

9 For more on AI and its growing impact on the economy, please see as an example, “Global AI Survey: AI proves its worth, but few scale impact,” McKinsey, November 2019. Also see “The state of AI in 2020,” McKinsey & Company, November 18, 2020.

10 We proxy annualized volatility by the standard deviation, which is essentially the average deviation in monthly returns from the average return over the particular sample period. The calculations are based on the digital asset composite index described in the note to Table 1.

11 We calculated correlations between various cryptocurrency monthly price returns from December 2019 to December 2024. The results are broadly corroborated by recent research showing a high correlation among cryptocurrencies. See Aiman Harudin, Azhar Mohamad, Imtiaz Sifat, and Yusniliyana Yusof, “Cryptocurrencies: A Survey on Acceptance, Governance and Market Dynamics,” International Journal of Finance & Economics, December 14, 2020.

12 The first report in this series, “Intro to digital assets — What they are, what they do,” February 2025, explains these risks in more detail.

13 For more detail, please see Aiman Harudin, Azhar Mohamad, Imtiaz Sifat, and Yusniliyana Yusof, “Cryptocurrencies: A Survey on Acceptance, Governance and Market Dynamics,” International Journal of Finance & Economics, December 14, 2020.

14 The exchanges assist individuals in transacting digital assets but tend to have inferior security compared to a blockchain. Hence, the large number of breaches is associated with exchanges. See, for example, “These are the largest cyber thefts of the past decade – and 80% of them involve Bitcoin,” Fortune, April 6, 2021. Alternatively, see “Cloud Security Alliance Releases Guidance for Crypto-Asset Exchange Security,” Businesswire, April 13, 2021.

Risks Considerations

Virtual or cryptocurrency is not a physical currency, nor is it legal tender. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. An investor could lose all or a substantial portion of his/her investment. Cryptocurrency has limited operating history or performance. Fees and expenses associated with a cryptocurrency investment may be substantial. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies.

Digital currency also known as crypto currency or bitcoin, as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Digital assets may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers. Investments in equity securities are generally more volatile than other types of securities.

Exchange-traded funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed, or sold, may be worth more or less than their original cost. ETFs seek investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price and yield performance of the index can be fully matched.

Investing in commodities is not appropriate for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. The prices of various commodities may fluctuate based on numerous factors including changes in supply and demand relationships, weather and acts of nature, agricultural conditions, international trade conditions, fiscal monetary and exchange control programs, domestic and foreign political and economic events and policies, and changes in interest rates or sectors affecting a particular industry or commodity. Products that invest in commodities may employ more complex strategies which may expose investors to additional risks, including futures roll yield risk.

Alternative investments, such as hedge funds, private equity/private debt and private real estate funds, are speculative and involve a high degree of risk that is suitable only for those investors who have the financial sophistication and expertise to evaluate the merits and risks of an investment in a fund and for which the fund does not represent a complete investment program. They entail significant risks that can include losses due to leveraging or other speculative investment practices, lack of liquidity, volatility of returns, restrictions on transferring interests in a fund, potential lack of diversification, absence and/or delay of information regarding valuations and pricing, complex tax structures and delays in tax reporting, less regulation and higher fees than mutual funds. Hedge fund, private equity, private debt and private real estate fund investing involves other material risks including capital loss and the loss of the entire amount invested. A fund's offering documents should be carefully reviewed prior to investing.

Idiosyncratic risk is specific to as asset and has little or no correlation with market risk and can therefore be substantially mitigated or eliminated from a portfolio by using adequate diversification.

Definitions

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg Commodity Index is comprised of 22 exchange-traded futures on physical commodities and represents 20 commodities weighted to account for economic significance and market liquidity.

Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

MSCI All Country World Index (MSCI ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed and 26 emerging markets.

An index is unmanaged and not available for direct investment.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.