February 2025

Global Investment Strategy Team

Intro to digital assets — What they are, what they do

Key takeaways

- Digital assets have data-security, privacy, and personal-control features that greatly improve the exchange of items of value over the internet.

- We expect further growth in digital assets and believe education is paramount when considering these assets as investments.

What it may mean for investors

- We believe digital assets are investable as they continue to evolve.

This report, the first in a four-part introductory series on digital assets, provides an overview of what digital assets are and their importance to the digital future. Other reports in the series explain in more detail why we believe digital assets are investable and why we believe it is neither too early nor too late to consider investment opportunities in digital assets. We also offer a Q&A report with brief answers to some of the questions we see most often from investors about digital assets. We plan to add periodically to this series to support investor understanding of these assets.

What are digital assets?

Digital assets are items of value that can be securely owned, collected, traded, or invested in over the internet. They can be digitized items of value, such as photos, a will, a loan, or money. Digital assets also can be digitized claims on physical things, such as oil paintings and homes. Other digital assets can be securely exchanged over the internet as a means of payment, person to person, without the need of banks or governments to mediate. Bitcoin is the best known of this group, but there are many others.

Digital assets differ in construction, but there are common principles most share. To illustrate, converting a house deed into a digital asset is done by creating a digital version of the deed, which is then called a token. This token is stored on a digital ledger, called a blockchain, which tracks ownership and transactions. A block is a collection of transactions, grouped in a chain. Transactions in digital assets accumulate in a block by a process, called validating or mining. The validation process secures each transaction by verifying its authenticity and fusing it into a block. Validators, or miners, are computer systems run by the users of a blockchain, who are incentivized with rewards to secure the blockchain and act honestly.

Digital assets are already gaining traction in the economy

Much of what is published about digital assets centers on them as investments but neglects their supporting technologies and possible everyday uses. The examples below illustrate the diversity of digital assets today. We believe that these everyday uses ultimately may help drive investment demand as households and businesses become more comfortable owning, exchanging, and even paying with digital assets.

Art, music, and entertainment

Digital asset adoption in the music industry is already well established. Artists can go directly to fans and fans directly to artists, cutting out many middle parties. A recent example came from a popular rock band that released a special, more expensive version of an album as a digital asset.1 Fans who bought the album in digital-asset form gained access to unique experiences, such as spending time with the band, lifetime front-row tickets, and exclusive merchandise.

Digital assets allow the fans to own personalized albums as assets. Even if the fan sells the album, the technology allows the artist to track and even retain control over the rules of ownership and usage. In this example, the band structured its digital asset for the fan and the band to co-own the asset. Should the fan decide to resell the special digital asset in the aftermarket, the sale triggers hard-coded instructions to pay the band a portion of the sale’s proceeds. The band trusts this arrangement because the technology behind digital assets tracks, verifies, and hard codes each transaction onto an unalterable digital ledger. Ultimately, the band may look to release all concert tickets as a digital asset to ensure a percentage of the proceeds from any ticket resales.

Health care

Some digital-asset projects give patients the ability to securely move and store their medical records, all from their personal digital devices. The technology allows the patient to control and set rules around access, instead of the health care company or provider. Gaining access to personal information without the owner’s permission is nearly impossible. This technology is likely a step up for those worried about privacy today.

With greater individual control comes potential opportunity, too. As an example, most insurance and health care companies today collect and use our data for free, parsing it to understand everything from habits to family histories.2 For those willing to engage, there is potential to profit from selling one’s health care data.

Real estate

In real-estate markets, one digital-asset project we know of is working to upgrade the Multiple Listing Service so that brokers and agents with permission can confidently examine the entire history of a listing documented accurately and securely.3 The history stored on the blockchain could include everything from selling prices to renovations and plumbing repairs to insurance and legal claims. Notably, blockchains are open for all to see, but adding data requires permission. Further, data added to a blockchain is exceedingly difficult to remove. The added confidence could potentially save time and money. Storing deeds and titles onto blockchain can make paper copies all but obsolete.4

Digital assets also can help manage rental properties. Renting properties can require manual, repetitive, and time-consuming tasks, but a token or blockchain can streamline these processes. Tokens have an operating engine called a smart contract that automatically executes the terms and conditions of the rental contract. Countless processes can be automated, from payment schedules and direct deposits to logging maintenance records. Tokens can replace the application process too. Tokens can securely store personal information on personal digital devices with smart contracts programmed to release as much information, or as little, as needed.

The largest impact could come on the financing side. Multiple projects are underway to help make it easier to invest in and divest of real-estate holdings. A house seller, as an example, could sell a home to four different investors. The four investors each receive a house crypto coin that represents one-fourth of the house. As the value of the home appreciates, so should each coin’s value. The coin could also have hard-coded ownership rules, such as the right of first refusal to buy an investor’s coin should another owner choose to sell.5

Cities and states

Private individuals and companies are developing most digital-asset projects, but cities and states are becoming involved too. As an example, the state of Illinois has started the Illinois Blockchain Initiative, which aims to use blockchains to enhance security around social security numbers, birth certificates, voter registration cards, and other records.6 California is another example of a state using blockchains. In July 2024, California’s Department of Motor Vehicles (DMV) digitized 42 million car titles to help detect fraud and simplify the title transfer process.7

Protecting personal data

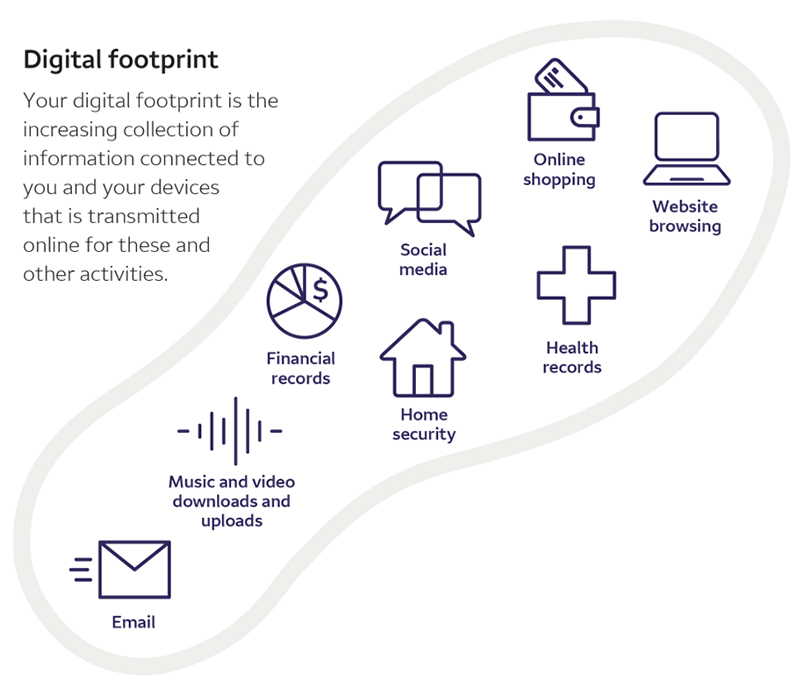

The last example, protecting our personal data, may be the most important long-term application of this technology. In 1956, IBM created a revolutionary hard-disk-drive computer that could store what was then an astonishing 5 megabytes of data. Today, the average person can create that in a matter of seconds. Over the average 24-hour period in 2023, users sent nearly 18.7 billion text messages, published 500 million tweets on Twitter, and watched 5 billion YouTube videos.8 The vast majority of this data is owned and controlled by companies and governments, not the individual creators of the data. Digital assets can give individuals the tools to secure individual property rights and claim ownership and control over their personal digital data, as shown in Chart 1.

Source: Wells Fargo Investment Institute, October 2024.

Source: Wells Fargo Investment Institute, October 2024.In sum, the examples above illustrate the potential we see in these assets to simplify the process of buying and exchanging the titles to various assets. Whether it be a smart contract or a house deed that has been tokenized for the owners, digital assets have the potential to speed up transactions and settlement platforms across the financial industry. We believe the efficiency characteristics of digital assets will drive wider adoption in the coming years.

Digital assets that can be used as investments

Henceforth, this report will use the term “digital assets” to refer to those that are useful as a form of payment or as investments. The two largest digital assets by market capitalization (as of January 15, 2025) are bitcoin and Ethereum, are known as digital coins, because they operate their own blockchains. The fourth largest, Tether, does not reside on its own blockchain and so is called a token.

Fixed or slow-growing supplies are common across investable digital assets, such as bitcoin and others.9 Their market value thus rises and falls with demand. Further, because they can hold value and are exchangeable at a publicly known price, they possess some of the characteristics of a currency. However, bitcoin and similar digital assets do not have the same monetary policy flexibility of currencies issued and controlled by a government. In the case of the U.S. dollar, as an example, the Federal Reserve can change the supply (and hence the value) of dollars by quickly changing its monetary policy. Changing the supply of digital assets is possible but rare. Also, changes typically require the largest holders to agree, or majority of holders, and consensus building like this takes time.

Bitcoin is the most prominent example of a digital asset

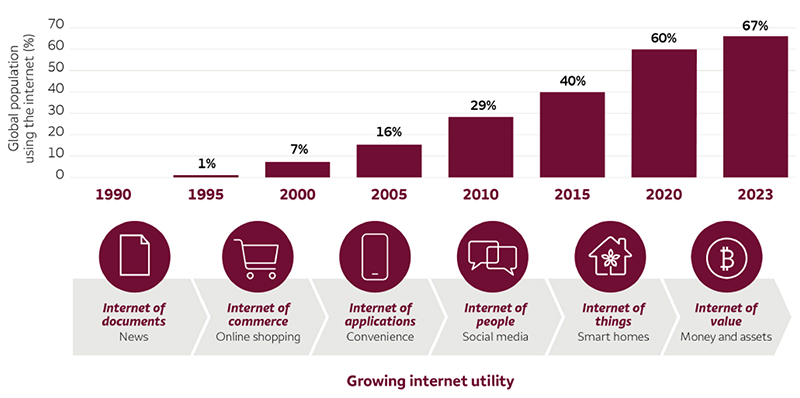

Bitcoin is the first digital asset, dating to 2009, and many others have used parts of its blueprint, making bitcoin a key part to understanding what digital assets can do and what they are about. Chart 2 shows the progression of innovations that are recognizable in different parts of daily life. Each step took years to accomplish and often built

Sources: Wells Fargo Investment Institute, The World Bank, International Telecommunication Union (ITU), World Telecommunication/ICT Indicators Database as of latest annual update (September 30, 2024).

Sources: Wells Fargo Investment Institute, The World Bank, International Telecommunication Union (ITU), World Telecommunication/ICT Indicators Database as of latest annual update (September 30, 2024).upon earlier steps. Bitcoin was the first technology to show that those known technologies, such as blockchains and cryptography, can allow individuals to securely store, control, and prove ownership over their personal digital assets without the help of a third party. Today, we view bitcoin and similar digital assets as an increasingly important technology and asset in the U.S. economy.

The technology platform behind digital assets

Digital asset structure has some basic features: 1) blockchains, 2) decentralization, and 3) cryptography.

Blockchains: The first key security feature of digital assets is that removing a transaction from a blockchain can be exceedingly difficult, because the validation process is mathematically intense. And some blockchains, like bitcoin, use energy intensity to make reversing a transaction nearly impossible (we never say never when it comes to computer security). Another security feature is that blockchains are open for anyone interested to see any transaction, because it trusts no single authority with that responsibility.

Decentralization: A second key security feature of the platform has been that most blockchains are designed to be decentralized, which means that they are not held in one central location or controlled by one entity. Copies of the blockchain are spread across a global network of computers, and anyone interested can keep a copy.

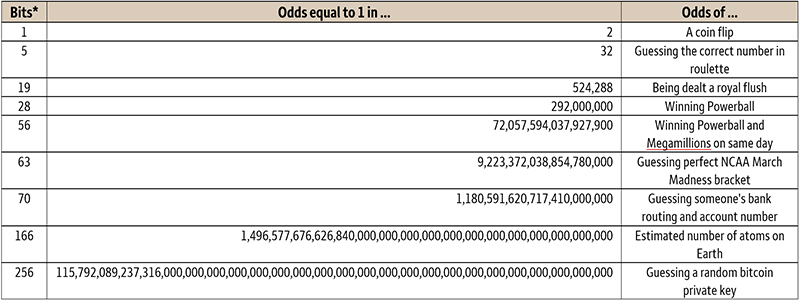

Cryptography: Lastly, a digital asset is wrapped in cryptography and stored in a personal digital wallet. Any digital device can access a personal digital wallet, but only with a private key, which is typically 50 – 60 digits long and known only to the owner. Table 1 helps visualize the very long odds of cracking a private key for a particular digital asset. Others have calculated that the probability is more similar to that of winning the Powerball lottery nine consecutive times.10 We are not saying that investing in bitcoin is equivalent to gambling but use these examples to contextualize the difficulty of breaking into someone’s digital key.

| Bits* | Odds equal to 1 in … | Odds of … |

|---|---|---|

| 1 | 2 | A coin flip |

| 5 | 32 | Guessing the correct number in roulette |

| 19 | 524,288 | Being dealt a royal flush |

| 28 | 292,000,000 | Winning Powerball |

| 56 | 72,057,594,037,927,900 | Winning Powerball and Megamillions on same day |

| 63 | 9,223,372,038,854,780,000 | Guessing perfect NCAA March Madness bracket |

| 70 | 1,180,591,620,717,410,000,000 | Guessing someone's bank routing and account number |

| 166 | 1,496,577,676,626,840,000,000,000,000,000,000,000,000,000,000,000,000 | Estimated number of atoms on Earth |

| 256 | 115,792,089,237,316,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000 | Guessing a random bitcoin private key |

Main investment risks we foresee

Since 2022, Bitwise and VetaFi conducted annual surveys of investment professionals on digital-asset investing.11 The points below provide more details on the topics.

- Regulation. Additional regulation structure for such a young asset class can mean more transparency, which we believe will drive institutional interest and, potentially, performance.

- Volatility. Digital assets have been volatile and can generate significant ups and downs, in proportion to their share in the portfolio. Diversifying digital-asset exposure may help reduce portfolio volatility.12

- Valuation. This is a young asset class, and we do not yet see a consensus on how to measure fair value on digital assets. By contrast, such tools have long been available for fixed income and equities. While price volatility continues, we prefer valuation methods that combine such metrics as network activity and wallet counts. Meanwhile, volatility has declined as the number of investors has grown in recent years. The annualized volatility in a digital-asset index was 277% between January 2011 and January 2016, but that figure was more than halved to 79% from December 2019 to December 2024.13 As more investors join this market, we believe volatility will fall further and make valuation more straightforward.

- Accessibility. Accessibility to digital-asset investments for U.S. investors has been relatively limited over the past decade. The complexity of the technology probably has deterred some investors, and the still-evolving regulatory structure likely also creates investor hesitation and limits investment products. In January 2024, however, the Securities and Exchange Commission approved the launch of several spot-based bitcoin exchange-traded funds (ETFs), providing an easily accessible investment vehicle to gain exposure to digital assets. As the adoption and normalization of digital assets grows as an investment asset class, we believe accessibility will become easier.

- Security. Newcomers often rely on intermediaries to buy, sell, and store their digital assets because interacting peer-to-peer can be technically complex. But the intermediary’s security may be less rigorous than the blockchain’s. Millions of dollars in thefts have been reported through the years. In 2023 alone there were more than 231 reported attacks, and there may be others that go unreported.14 Most thefts have not occurred on the blockchains themselves, which is critical to the survival of the industry. Rather, the breaches have been due to users not securing their digital assets properly in their digital wallets or using an unsecure intermediary. We expect that security options and investors’ understanding of how to best secure their digital assets will reduce this risk.

- Association with criminal activity. Significant financial-crimes risks exist in the financial industry, including in digital assets. For example, digital assets have been used to commit certain types of fraud. The range of examples includes email phishing for private keys and con artists promoting fake coins, so thorough due diligence is needed. In addition, as the digital-assets industry has grown, so have the number of government enforcement actions in the U.S. and abroad, in response to bad actors using digital assets to commit money laundering, sanctions evasion, and terrorist financing. It is worth recognizing, however, that any financial asset could potentially attract bad actors. As an example, nearly $33.45 billion of credit card fraud, in U.S. dollars, occurred in 2022 alone. By contrast, the latest data show that illicit activity in digital assets represented 0.34%, or approximately $24.2 billion, of all digital-asset transaction volume in 2023.15

Parameters for investing in digital assets

A singular feature of these investable digital assets is that the supplies of the more prominent assets tend to be fixed or expand slowly, thus providing some price support. However, the following are examples of factors that may drive demand — and hence price — at a particular moment.

- Utility. We foresee that wider use of digital assets in daily life (as described above) will help drive the utility of digital assets and, in turn, the investment demand for those assets that can be used in exchange or for investment. Higher utility should drive demand and price higher. As new coins emerge, some can compete better with established coins.

- Regulatory structure. This is a developing and important factor that can restrict how coins may be used and exchanged (and thus influence utility).

- Liquidity. This refers to how efficiently a coin or token may be transacted. Low liquidity suggests a buyer may have to pay more for a scarce coin or that a seller may have to consider how many coins to offer before driving down the price.

Spot-based bitcoin ETFs, for clarity, provide investors direct exposure to bitcoin’s price movements, but they do not provide direct ownership of bitcoin. Direct ownership always resides with the entity that holds the private keys to bitcoin, which in this case is the ETF provider. When an investor buys bitcoin through a spot ETF, the fund holds the bitcoin on behalf of the investor, securing it with an outside custodian. The investor does not hold the digital asset directly but receives a number of ETF shares consistent with the share of the fund’s assets. We expect more ways to invest as the industry and investors come to understand better the trends toward digitization in economic activity and the demand for digital assets and blockchain technologies.

Conclusion

We view digital assets as part of a set of technologies that will shape the next digital era by focusing on protecting an individual’s digital privacy, data, and assets. In so doing, they may change the ways people use the internet to make transactions, secure personal data, and even run a business. In particular, bitcoin and other investable coins and tokens, have uses like a digital money and a global digital-payments system or, in other cases, an investment with a goal to increase value. Looking ahead, we believe digital assets could play an important role in day-to-day activity as the world continues to expand globally and digitally.

Our Wells Fargo Investment Institute introductory series on digital assets:

Intro to digital assets — What they are, what they do

Intro to digital assets — The investment rationale

Intro to digital assets — Too early or too late to invest?

Intro to digital assets — A short Q&A on the basics

1 Samantha Hissong, “Kings of Leon will Be the First Band to Release an Album as an NFT,” Rolling Stone, March 3, 2021.

2 Sohail Merchant, “Cryptocurrencies in Healthcare: Are Healthcare Coins the Future?” AIM by Merchant MD, January 29, 2021.

3 Victoria Chynoweth, “Real Estate Tokenization: A Start of A New Era In Property Management,” Forbes, March 20, 2024.

4 Garima Singh, “Revolutionizing Land Title Transfers: A Blockchain-Based Solution,” LinkedIn, June 14, 2024.

5 Sam Daley, “Blockchain in Real Estate: 17 Companies Shaping the Industry,” Built In, March 7, 2024.

6 Kyree Leary, “Illinois Is Experimenting with Blockchains to Replace Physical Birth Certificates,” Futurism, September 28, 2017.

7 “California DMV puts 42 million car titles on blockchain to fight fraud”, Reuters, July 30, 2024.

8 Don Tapscott and Alex Tapscott, “Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World,” Penguin, May 10, 2016.

9 Some digital assets have billions of coins, while others have smaller, fixed supplies. As an illustration, bitcoin’s hard-coded protocol fixes the supply cap at 21 million but with a diminishing supply growth over time. About every four years, the bitcoin reward that a miner gets for validating transactions and creating the next block in the chain gets cut in half. At bitcoin’s beginning in 2009, miners were rewarded 50 bitcoin with the right to produce the next block. In 2012, that reward dropped to 25 bitcoin reward per block. The rate halved again in 2016 to 12.5, in May 2020 to 6.25, and in April 2024 to 3.125 (according to Blockchain.com, "Total Circulating Bitcoin," and CoinMarketCap, "Bitcoin Halving Countdown.") Also according to CoinMarketCap, through January 22, 2025, about 19.8 million of the 21 million have been mined. Thus, the total is fixed but supply grows asymptotically slower over time.

10 Aaron Hankin, “The chance of hacking a bitcoin wallet is as likely as winning Powerball – 9 times in a row,” CryptoWatch by MarketWatch, March 6, 2018.

11 Matt Hougan, Juan Leon, and Todd Rosenbluth, “Bitwise/VettaFi 2025 benchmark survey of financial advisor attitudes toward crypto assets,” Bitwise, January 9, 2025.

12 For a more detailed discussion of digital assets in diversification, please see our report “Intro to digital assets — The investment rationale,” February 2025.

13 Digital-asset prices are represented by a composite (December 2010 = 1) of our construction that consistently has captured roughly 90% of market capitalization (calculated as circulating supply times price) and the growing diversity of the market over time. The composite constituents are the price of bitcoin from December 2010 to August 2015; a market-cap weighted combination of the bitcoin and Ethereum prices (market weights and Ethereum price from CoinCodex) from September 2015 to July 2017; and the Bloomberg Galaxy Crypto Index from its inception in August 2017 through December 2024. As can be seen in Chart 2, first bitcoin, and later bitcoin and Ethereum together, represented roughly 90% of market capitalization until mid-2017. The Bloomberg Galaxy Crypto Index includes bitcoin and Ethereum but adds other digital assets for diversity, and it represented approximately 90% of market capitalization as of December 2024.

14 “The 2024 Crypto Crime Report,” Chainalysis, February 2024.

15 Ibid.

Risks Considerations

Virtual or cryptocurrency is not a physical currency, nor is it legal tender. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. An investor could lose all or a substantial portion of his/her investment. Cryptocurrency has limited operating history or performance. Fees and expenses associated with a cryptocurrency investment may be substantial. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies.

Digital currency also known as crypto currency or bitcoin, as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Digital assets may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers. Investments in equity securities are generally more volatile than other types of securities.

Exchange-traded funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed, or sold, may be worth more or less than their original cost. ETFs seek investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price and yield performance of the index can be fully matched.

Sector investing can be more volatile than investments that are broadly diversified over numerous sectors of the economy and will increase a portfolio’s vulnerability to any single economic, political, or regulatory development affecting the sector. This can result in greater price volatility. Real estate has special risks including the possible illiquidity of underlying properties, credit risk, interest rate fluctuations and the impact of varied economic conditions. Some of the risks associated with investment in the Health Care sector include competition on branded products, sales erosion due to cheaper alternatives, research and development risk, government regulations and government approval of products anticipated to enter the market.

Definitions

Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

An index is unmanaged and not available for direct investment.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.