January 18, 2024

John Laforge, Head of Real Asset Strategy

Q&A on new spot bitcoin exchange traded funds

Key takeaways

- On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) announced the approval of 11 spot-based bitcoin exchange traded funds (ETFs) — the first of their kind in the U.S.

- Spot-based bitcoin ETFs give investors direct exposure to the daily prevailing market price of bitcoin without the complexities of managing bitcoin ownership directly.

What is bitcoin?

Bitcoin is the world’s first money and payments system that is global and open for anyone in the world to use. Its significance is greater than digital money, though. Bitcoin is a technological breakthrough that proved that all manner of digital valuables could be transferred and stored over open, global networks. This led to thousands of competitors copying bitcoin’s core innovation since its creation in 2009, forming the building blocks of a new internet for money and finance.

Source: Wells Fargo Investment Institute, January 2024. For illustrative purposes only.

Source: Wells Fargo Investment Institute, January 2024. For illustrative purposes only.What does the SEC approval mean for investors?

The news from the SEC was significant on multiple fronts. Spot-based bitcoin ETFs give investors direct exposure to the daily prevailing market price of bitcoin without the complexities of managing bitcoin ownership directly. The news was a milestone for bitcoin, too, as the first application for a spot-based bitcoin ETF was filed back in 2013. Traditional investors also offer a new source of demand for bitcoin and potentially other digital asset-based products in the future.

What will bitcoin ETFs invest in?

Each ETF is designed to track the price of bitcoin by investing directly in the asset. The ETF managers will buy bitcoin on behalf of customers, “exchanging” the customers’ U.S. dollars for shares in the ETF that are backed by the purchased bitcoin. Based on the number of bitcoin purchases, the managers then issue shares at the market price for bitcoin that are tradable on public exchanges.1 The ETF provider uses another company, a custodian, to ultimately hold and secure the bitcoin in a digital vault.

Will other digital assets besides bitcoin have ETFs? How will the investments vary by asset manager, and why is it important for investors to understand what they own?

Bitcoin will be the only digital asset that these funds buy. Each ETF is designed to track the price of bitcoin directly. Investment returns for each fund, however, will not necessarily be uniform across products as cost structures vary. It is also important to understand that purchasing spot-based ETFs give investors exposure to bitcoin’s price movements, but not direct ownership in bitcoin. For some, this may matter as the ability to hold and control one’s own bitcoin is a unique characteristic of the bitcoin invention.

What factors will drive bitcoin ETF prices up or down?

The price of spot-based bitcoin ETFs will be driven by the same factors that drive the price of bitcoin. The number of potential short-term factors are too numerous to list. That said, consumer sentiment is frequently at the top of this list. Over the long-term, the direction of bitcoin and spot-based bitcoin ETFs will likely be tied to secular trends in demand and supply. On the demand side, the key trends are user adoption and network effects. A network effect means that as more people use a product or service, its value rises to others. A digital social network, as an example, is more useful to an individual when it has lots of friends and family connected to it. Supply could be the factor that matters most to prices long-term, though. Bitcoin’s supply is limited to 21 million coins, of which 19.6 million have already entered circulation. The remaining 1.4 million coins will be distributed between 2024 and 2140 at a progressively slowing rate.

What are the potential risks of investing in bitcoin ETFs?

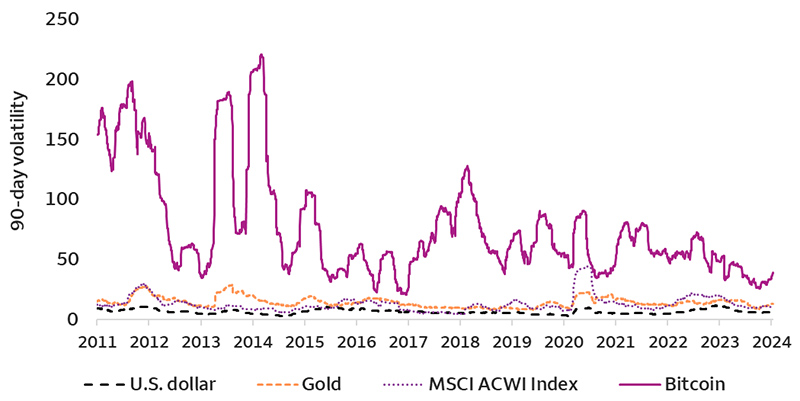

Bitcoin ownership carries potential risks such as future government regulation, technology failures, and digital asset competition. Over the short-to-medium term, investors should be aware of bitcoin’s extreme price volatility — its daily average volatility is roughly three and a half times that of equities, represented by the MSCI ACWI Index (chart on following page). Highlighted a different way, bitcoin’s price return in 2022 was -64% while its 2023 return was 157%.

Sources: Bloomberg, Wells Fargo Investment Institute. Daily data is from January 3, 2011 - January 17, 2024. The 90-day price volatility equals the annualized standard deviation of the relative price change for the 90 most recent trading day's closing price, expressed as a percentage. Past performance is not a guarantee of future results. An index is unmanaged and not available for direct investment.

Sources: Bloomberg, Wells Fargo Investment Institute. Daily data is from January 3, 2011 - January 17, 2024. The 90-day price volatility equals the annualized standard deviation of the relative price change for the 90 most recent trading day's closing price, expressed as a percentage. Past performance is not a guarantee of future results. An index is unmanaged and not available for direct investment.1 As the price of bitcoin ETF shares may trade at a premium or discount to the underlying bitcoin price, the managers create or redeem ETF shares to align the share price with the bitcoin price.

Risks Considerations

Each asset class has its own risk and return characteristics. The level of risk associated with a particular investment or asset class generally correlates with the level of return the investment or asset class might achieve. Exchange Traded Funds seek investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the price and yield performance of the index can be fully matched. Exchange Traded Funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost.

Virtual or cryptocurrency is not a physical currency, nor is it legal tender. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. An investor could lose all or a substantial portion of his/her investment. Cryptocurrency has limited operating history or performance. Fees and expenses associated with a cryptocurrency investment may be substantial. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not backed or supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies.

Definitions

MSCI All Country World Index (MSCI ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed and 26 emerging markets.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI.

An index is unmanaged and not available for direct investment.

General Disclosures

Global Investment Strategy (GIS) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Investment Strategy. Opinions represent GIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GIS does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.