November 9, 2023

Key impacts of infrastructure investment

Key takeaways

- Large fiscal packages are influencing investment activity in the U.S. — Wells Fargo Investment Institute sees this as having an outsized impact on the Industrials and Materials sectors, on which we are favorable.

- Within Industrials and Materials, we would recommend investors gain exposure to potential beneficiaries through the Multi-Industrials and Construction Materials sub-sectors.

- Among other sectors, we generally see a less meaningful impact at the broad sector level, but we do see investment opportunities in targeted areas.

Impact in the broader economy

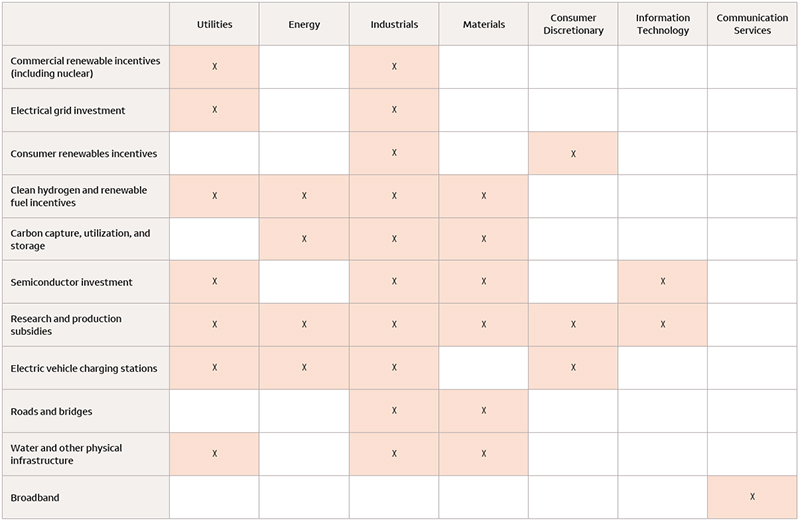

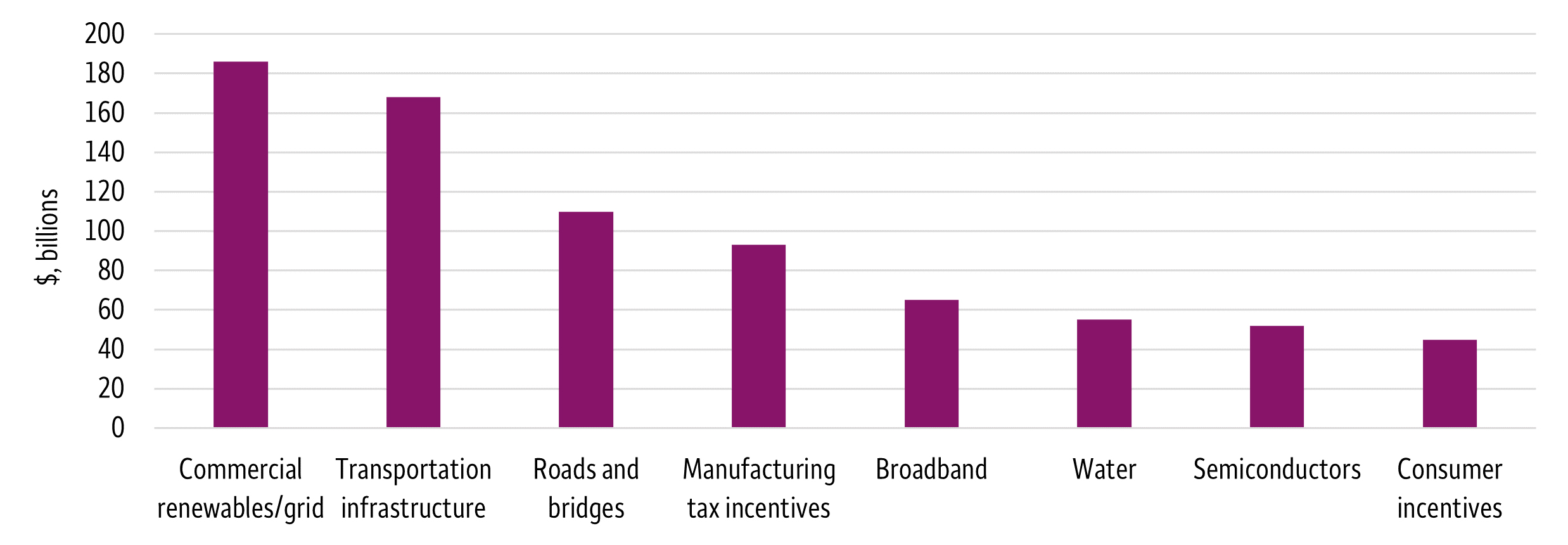

$972 billion. We could have rounded up and inserted one trillion for simplicity. That dollar figure is the collective amount of new funding provided by three significant pieces of legislation passed by Congress in 2021 and 2022 — IIJA (Infrastructure Investment and Jobs Act), IRA (Inflation Reduction Act), and CHIPS (Creating Helpful Incentives to Produce Semiconductors and Science Act). Funds are slated to be disbursed between 2022 and 2032. The overarching objectives are to improve American infrastructure, incentivize companies to locate production of certain items in the United States, and provide support for the energy transition.

Sources: Congressional Budget Office, The White House, Wells Fargo Investment Institute. Data as of August 2022.

Sources: Congressional Budget Office, The White House, Wells Fargo Investment Institute. Data as of August 2022.Business investment in a number of targeted areas has been robust

The American Clean Power Association estimates that $271 billion in utility-scale renewable energy projects (and supporting supply chain efforts) were announced between August 2022 and August 2023. Although most of the projects will be developed over multiple years, the association noted that this total would approximate total U.S. utility-scale renewable development between 2015 and 2022. The Semiconductor Industry Association estimates that $210 billion in chip manufacturing plants (fabs) have been announced since the CHIPS Act was first introduced in June 2022 through July 2023. The U.S. Treasury Department estimates that from the passage of the Inflation Reduction Act through July 2023, companies have announced $110 billion in investment for manufacturing capacity to produce items such as electric vehicle batteries as well as wind and solar equipment in the United States.

We believe momentum could continue in these areas and others, such as hydrogen and carbon capture, as technologies and industries scale over time. The IRA could have a particularly large multiplier effect on private capital investment, with Princeton University estimating that it could drive $3.5 trillion in total investment by 2032. We would acknowledge that this increased investment is not solely due to the passage of legislation. Changing industry demand patterns, global supply chain dislocations, an evolving geopolitical landscape, and preexisting trends toward alternative energy and high-tech investment are all drivers in the background.

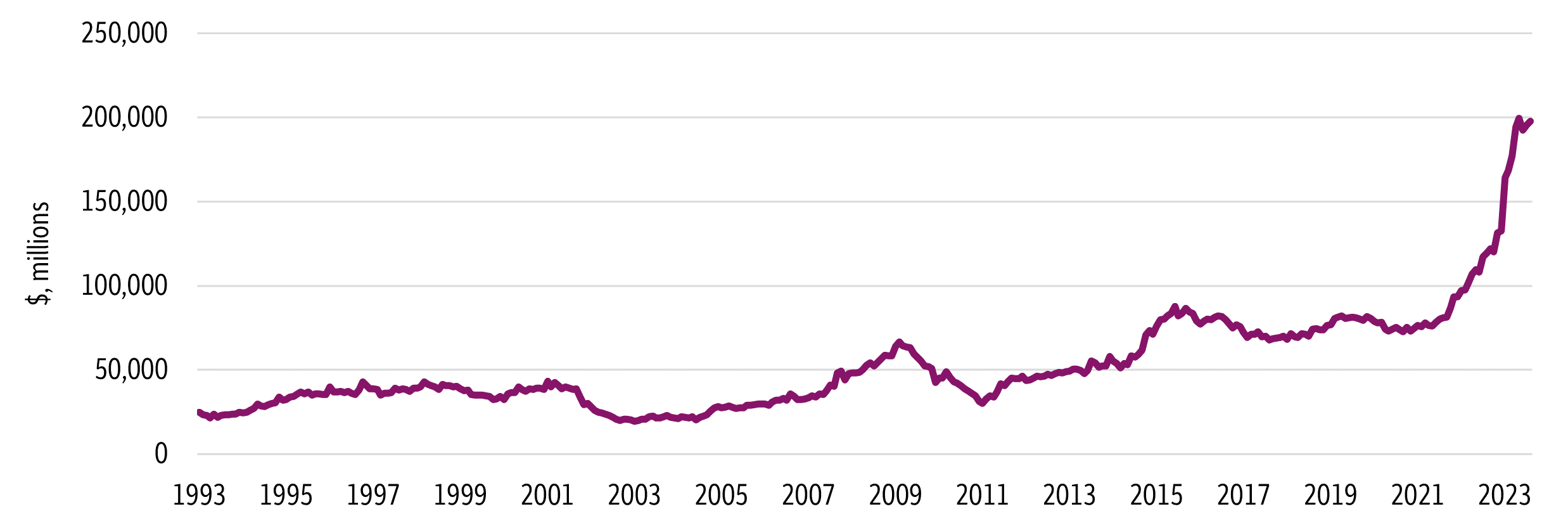

Construction spending the most visible impact

The most significant impact we have observed is in nonresidential construction. Private manufacturing construction spending is currently near all-time highs. For some perspective, the August 2023 reading was at a seasonally adjusted annual run rate 66% higher than the month prior to the passage of the IRA and CHIPS bills and 244% higher than the comparable 2019 period. Meanwhile, supported by provisions of the IIJA, August 2023 total public construction spending was roughly 20% higher compared to levels from two years prior. Categories with significant growth include highway and street, power, water, and sewage and waste disposal. These higher levels of activity in heavy construction have in turned supported certain industries such as steel, aggregates, and construction equipment.

Sources: U.S. Census Bureau, Wells Fargo Investment Institute. Total private construction spending: manufacturing in the United States; seasonally adjusted annual rate. Data as of October 2023.

Sources: U.S. Census Bureau, Wells Fargo Investment Institute. Total private construction spending: manufacturing in the United States; seasonally adjusted annual rate. Data as of October 2023.Expected impact into 2024 and beyond

Most of the investment that we are currently seeing will occur over multiyear timeframes. Using the example of a semiconductor factory, construction and tooling can take three to five years.1 Although broader macroeconomic factors will likely cause the net impact on each industry to fluctuate, we would expect this activity to provide a consistent uplift in many areas. For instance, a large steelmaker projects that the combined impact of the legislation will result in five to eight million tons of incremental steel demand annually through 2030. Thus, we would expect the strong construction activity in impacted areas to be sustained over the next several years. We would also expect the impact to broaden out to machinery makers and service providers who supply these facilities as the construction cycle matures and production begins to ramp.

Investment implications

We believe fiscal spending directed toward physical infrastructure and industrial capacity is driving higher levels of investment, both public and private, in these areas. In our view, the Industrials and Materials sectors (which are favorably rated by Global Investment Strategy) are the most likely to experience a positive impact in both the short and medium term. We would acknowledge that business investment and industrial activity are subject to a large number of variables, and our current expectation for an economic slowdown in the near term could create a degree of volatility in these sectors. That said, we believe targeting the higher-quality areas within these sectors is a prudent strategy, and we would suggest that investors be opportunistic.

Within Industrials and Materials, certain beneficiaries stand out in sub-sectors such as Multi-Industrials (favorable rating), Construction Machinery and Heavy Transportation Equipment (neutral rating), Construction Materials (favorable rating), and Industrial Gases (favorable rating).2 Amongst the other sectors covered in this report, we generally see a less meaningful impact at the broad sector level, but we do see investment opportunities in targeted areas.