Why should someone invest in stocks? Historically, stocks have performed well when compared to other asset groups and have typically outpaced inflation. Wells Fargo Investment Institute believes stocks play an important role inside a well-diversified portfolio. Before allocating capital to this asset group, we recommend investors consider the following elements:

1

Performance

2

Volatility

3

Diversification

Stocks have historically produced robust returns

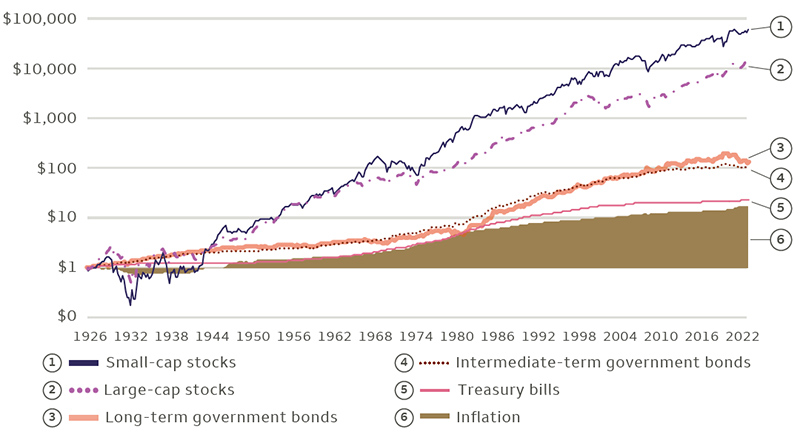

The chart below shows the hypothetical outcome of $1 invested in different U.S. asset classes in 1926 and held through 2023. All income is reinvested in this illustration; in other words, dividends received purchased more shares of stock and interest payments from bonds purchased more bonds. The study shows that small- and large-cap stocks have significantly outperformed government bonds and Treasury bills over this 98-year period. It shows that the $1 investment in small-cap stocks grew 11.8% on a nominal, annualized basis and large-cap stocks averaged 10.3%. Long-term government bonds advanced 5.1%, intermediate-term government bonds grew 4.9%, and Treasury bills advanced 3.3%.

What investors may not appreciate when looking at Figure 1 is how dramatically stocks have outperformed other asset classes over the long term as the chart uses a logarithmic scale for the vertical axis in order to fit on a single page.

| Assets class | Ending value | Annualized return |

|---|---|---|

| Small-cap stocks | $57,813 | 11.8% |

| Large-cap stocks | $14,568 | 10.3% |

| Long-term government bonds | $133 | 5.1% |

| Intermediate-term government bonds | $104 | 4.9% |

| Treasury bills | $23 | 3.3% |

| Inflation | $17 | 2.9% |

| Small-cap stocks | |

|---|---|

| Ending Value | $49,052 |

| Annualized return | 11.8% |

| Large-cap stocks | |

| Ending Value | $11,535 |

| Annualized return | 10.1% |

| Long-term government bonds | |

| Ending Value | $131 |

| Annualized return | 5.2% |

| Intermediate-term government bonds | |

| Ending Value | $101 |

| Annualized return | 4.9% |

| Treasury bills | |

| Ending Value | $22 |

| Annualized return | 3.2% |

| Inflation | |

| Ending Value | $17 |

| Annualized return | 2.9% |

Note: Large-cap stocks are represented by the Standard & Poor’s (S&P) Composite from 1926 – 1928, the S&P 90 Index from 1928 through February 1957 and the S&P 500 Index thereafter. Small-cap stocks are represented by the lowest 5% of the market universe defined as the aggregate of the NYSE, NYSE Amex, and NASDAQ National Market System or companies smaller than the 1,500th largest U.S. company in the same market universe, whichever results in a higher market capitalization break. Long-term government bonds are represented by U.S. government bonds with a maturity of about 20-years, intermediate-term bonds are represented by the U.S. government bonds with a maturity of about 5.5 years, and Treasury bills by the 30-day U.S. Treasury bill. Inflation is measured by the Consumer Price Index, which measures changes in the price level of a market basket of consumer goods and services.

Outpacing inflation over the long term

The returns we have examined thus far are nominal returns, meaning they ignore the effects of inflation. Adjusting nominal returns for the nearly ever-present force that eats away at spending power gets us to real returns. Theoretically, if inflation in any given year is 3%, an individual’s income would need to grow by 3% to simply maintain purchasing power. Therefore, an investor needs some level of growth above inflation, real growth, to make headway.

As an example, during the 98-year period ranging from 1926 through 2023, inflation averaged 2.9% per year. Subtracting that from our previously noted returns provides real returns for the asset classes — 8.9% for small-cap stocks, 7.3% for large-cap stocks, 2.2% for long-term government bonds, 1.9% for intermediate-term government bonds, and 0.3% for Treasury bills. Stocks again came out on the top of the heap, providing returns that comfortably exceeded inflation on a real basis.

What this means for investors

Expect stocks to be a top-performing asset group

U.S. large-cap stocks have produced an average annual return of 10.3%, outperforming most other asset classes over the long term.

Stick to your plan

Investor sentiment toward U.S. large-cap stocks can oscillate between optimism and pessimism; look no further than 2021 to 2023, when yearly returns went from 29% to -18% to 26%. However, we believe a well-diversified stock portfolio will continue to outperform fixed income and cash alternatives over the long run.

Stocks can provide income, too

While investors tend to use bonds as their main income-producing investment, stocks also provide income returns in the form of dividends. Since 1926, large-cap stocks have produced an average dividend return of 3.9% each year.

Corrections are inevitable, but not predictable

We have seen the stock market rise and fall many times throughout history. Using the history of the stock market to understand typical market behavior can be an important tool to provide perspective so investors can prepare appropriately. We believe market corrections are inevitable, but not predictable. On average since 1928:

- Dips in the stock market — defined as a decline of 5% or more — have occurred more than three times a year.

- Corrections in the stock market — defined as a decline of 10% or more —have occurred about one time a year.

- Bear markets — defined as a decline of 20% or more — have occurred once every three to four years and are usually tied to recessions.

| Type of correction | Dips (decline of 5% or more) | Corrections (decline of 10% or more) | Bear market (decline of 20% or more) |

|---|---|---|---|

| Occurences since 1928 | 329 | 103 | 27 |

| Occurences per year | 3.4 per year | 1.1 per year | 1 every 3.6 years |

| S&P Index annualized return since 1928: 9.9% | |||

| Occurences since 1928 | |

|---|---|

| Dips (decline of 5% or more) | 327 |

| Corrections (decline of 10% or more) | 102 |

| Bear market (decline of 20% or more) | 27 |

| Occurences per year | |

| Dips (decline of 5% or more) | 3.4 per year |

| Corrections (decline of 10% or more) | 1.1 per year |

| Bear market (decline of 20% or more) | 1 every 3.5 years |

| S&P 500 Index annualized return since 1928: 9.9% | |

What this means for investors

Long-term investors will likely experience many market pullbacks

If you plan on investing in the stock market over many decades, you will likely experience many dips, corrections, and bear markets. Pullbacks are a normal part of investing, so we recommended that you stick to your plan, especially through challenging environments.

Pullbacks can be opportunities

Market corrections and downturns can be difficult to endure. However, sell-offs can potentially offer opportunities for investors to purchase high-quality stocks at lower prices.

Consider investing regularly with dollar cost averaging

Dollar cost averaging involves investing the same amount of money in a target security at regular intervals, regardless of price. By using dollar cost averaging, investors may lower their average cost per share by buying more shares when prices are lower and less when they are higher.

Think twice before reducing or eliminating a sector

While we may have a strong feeling of how the future will look, unforeseeable events often alter reality. As a result, making too large of a bet on any one particular outcome increases investor risk significantly, and investment strategies based on concentrated positions involve higher risk.

The foundation of modern portfolio theory suggests that having a well-diversified mix of major asset groups — primarily stocks, bonds, and cash alternatives — may help investors take advantage of different market environments and optimally balance risk and return. By drastically reducing or removing an asset group, such as stocks, investors may take on additional risk as they become more concentrated in their remaining investments.

In addition to the increased risk, consider the potential costs of a concentrated strategy. For example, many investors, nervous after the 2008 – 2009 financial crisis, moved assets out of the market — effectively, this left them holding significant concentrations in cash alternatives. While cash alternatives as an asset class have very low volatility, the opportunity cost realized because of those decisions was significant. From March 9, 2009 through December 31, 2023, equities were up more than 834% and bonds returned 50% while cash alternatives realized little return.1

What this means for investors

Start with an investment plan

Once investors determine their investment objective and the amount of risk they are comfortable with, they can establish a long-term investment plan with an appropriate asset allocation (investment mix) strategy.

Keep an eye on the future

An investment plan and asset allocation strategy can help prepare for what is happening now, what may happen in the short term, and, just as importantly, what could happen in the long term. Investors may need to adjust their objectives over time, and stocks can be part of a wide variety of plans.

Stay diversified

If investors become too reliant on any one particular asset group, whether it is stocks, bonds, or cash alternatives, portfolios may lack diversification and expose investors to excess risk.

1 Morningstar Direct. Data as of December 31, 2023. Equities based on the S&P 500 Index and bonds on the Bloomberg U.S. Aggregate Bond Index.

Asset allocation and diversification are investment methods used to help manage risk. They do not guarantee investment returns or eliminate risk of loss including in a declining market.

All investments are subject to market risk which means their value may fluctuate in response to general economic and market conditions, the prospects of individual companies, and industry sectors due to numerous factors some of which may be unpredictable. Be sure you understand and are able to bear the associated market, liquidity, credit, yield fluctuation and other risks involved in an investment in a particular strategy.

Equity securities are subject to market risk which means their value may fluctuate in response to general economic and market conditions and the perception of individual issuers. Investments in equity securities are generally more volatile than other types of securities. There is no guarantee dividend-paying stocks will return more than the overall market.

The prices of small and mid-cap company stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging and frontier markets.

Investments in fixed-income securities are subject to interest rate, credit/default, liquidity, inflation and other risks. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. Credit risk is the risk that an issuer will default on payments of interest and principal. This risk is higher when investing in high yield bonds, also known as junk bonds, which have lower ratings and are subject to greater volatility. If sold prior to maturity, fixed income securities are subject to market risk. All fixed income investments may be worth less than their original cost upon redemption or maturity. Although Treasuries are considered free from credit risk they are subject to other types of risks. These risks include interest rate risk, which may cause the underlying value of the bond to fluctuate.

U.S. government securities are backed by the full faith and credit of the federal government as to payment of principal and interest. Unlike U.S. government securities, agency securities carry the implicit guarantee of the U.S. government but are not direct obligations. Payment of principal and interest is solely the obligation of the issuer. If sold prior to maturity, both types of debt securities are subject to market risk.

Cash alternatives typically offer lower rates of return than longer-term equity or fixed-income securities and provide a level of liquidity and price stability generally not available to these investments. Some examples of cash alternatives include: Bank certificates of deposit; bank money market accounts; bankers’ acceptances, federal agency short-term securities, money market mutual funds, Treasury bills, ultra-short bond mutual funds or exchange-traded funds and variable rate demand notes. Each type of cash alternatives has advantages and disadvantages which should be discussed with your financial advisor before investing.

A periodic investment plan such as dollar cost averaging does not assure a profit or protect against a loss in declining markets. Since such a strategy involves continuous investment, the investor should consider his or her ability to continue purchases through periods of low price levels.

Bond rating firms, such as Moody’s, Standard & Poor’s and Fitch, use different designations consisting of upper- and lower-case letters ‘A’ and ‘B’ to identify a bond’s credit quality rating. ‘AAA’ and ‘AA’ (high credit quality) and ‘A’ and ‘BBB’ (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (‘BB’, ‘B’, ‘CCC’, etc.) are considered low credit quality, and are commonly referred to as “junk bonds”.

An index is unmanaged and not available for direct investment.

S&P 90 Index – In 1928 Standard & Poor’s realized the need to disseminate its market indicator information more frequently. Instead of trying to calculate the 233 Composite on an hourly or even a daily basis, which would have been difficult to do in an era before sophisticated calculators or computers were available, Standard & Poor’s created a more manageable subset of stocks. This new index was the first daily, and then the first hourly index published by Standard & Poor’s. Comprised of 50 Industrial, 20 Railroad, and 20 Utility stocks, it became known as the S&P 90 Stock Composite Index.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Consumer Price Index (CPI) produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services.

S&P 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks that is generally considered representative of the U.

Global Securities Research (GSR) is a division of Wells Fargo Investment Institute, Inc. (WFII). WFII is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

The information in this report was prepared by Global Securities Research (GSR). Opinions represent GSR’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. GSR does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report. Past performance is no guarantee of future results.

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability or best interest analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. The material contained herein has been prepared from sources and data we believe to be reliable but we make no guarantee to its accuracy or completeness.

Wells Fargo Advisors is registered with the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority, but is not licensed or registered with any financial services regulatory authority outside of the U.S. Non-U.S. residents who maintain U.S.-based financial services account(s) with Wells Fargo Advisors may not be afforded certain protections conferred by legislation and regulations in their country of residence in respect of any investments, investment transactions or communications made with Wells Fargo Advisors.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.