94%Percentage of women who believe they will be responsible for their finances at some point1

$10 trillionAmount of U.S. personal wealth women control2

Women comprise more than half of the U.S. population,3 but no two women are the same when it comes to managing their money. When we surveyed investors, women were optimistic about their ability to achieve short- and long-term investment goals and have become increasingly assured that the stock market is a good place to invest. We also found that women investors are more likely to work with an investment professional and more inclined to stick to their investment plan.4

At some point in their lives, most women likely will be in charge of their family’s finances.5 Women have increasingly become the sole or primary breadwinners for their families and often take a leading role in educating the next generation in financial matters. This report explores new trends in how women approach investing and offers guidance on how women can take advantage of their strengths as they pursue long-term financial goals.

Women and men face different challenges

5 yearsAmount of time that women outlive men, on average6

$0.83Amount women earn per dollar compared to men7

Studies reveal that women have smaller nest eggs when compared with men of similar age and income. There are several reasons why this may be the case. In our survey, women tended to invest more conservatively than men.8 Having a portfolio that is too conservatively invested may lead to underfunded goals. In fact, a 2023 study by Bank of America indicated that women have a median 401(k) account balance of about 50% less than that of men.9

Additionally, because women, on average, earn less per dollar than men and often report taking time off from work to care for others, they can fall behind financially. With careful planning and appropriate investment allocations, we believe women can be prepared to reach their financial goals.

1 “Bank of America Study Finds 94% of Women Believe They’ll be Personally Responsible for Their Finances at Some Point in Their Lives,” Bank of America, June 22, 2022

2 "Women as the next wave of growth in US wealth management," McKinsey & Company, July 2020

3 U.S. Census, 2020: Women were 51% of the U.S. population

4 Wells Fargo/Gallup Investor and Retirement Optimism Index, February 2021. Results for this Wells Fargo/Gallup Investor and Retirement Optimism Index are based on a Gallup Panel™ web study completed by 1,536 U.S. investors, aged 18 and older, from February 8 to 16, 2021. This quarter’s poll includes an oversample of Black and African American investors, resulting in a total of 573 Black and African American investors included in this survey. For this study, the American investor is defined as an adult in a household with stocks, bonds, or mutual funds of $10,000 or more, either in an investment account or in a self-directed IRA or 401(k) retirement account.

5 “Women’s Quick Facts: Compelling Data on Why Women Matter,” STEMconnector®, November 2016

6 World Health Organization, 2020

7 Bureau of Labor Statistics, 2024

8 “Women’s Quick Facts: Compelling Data on Why Women Matter,” STEMconnector®, November 2016

9 Bank of America, “BofA Data Finds Men’s Average 401(k) Account Balance Exceeds Women’s by 50%,” June 28, 2023

The wage gap is one factor that can set back women when it comes to attaining their retirement goals, but an extended career break can have an even greater impact. New mothers are more likely to take an extended career break than new fathers. An extended career gap and pause in contributions to a retirement account can have a drastic impact on the amount of assets available later in life.

The impact of a lower salary compounds over time, but a career break can have an even more devastating impact

The retirement assets of women with a two-year career break are projected to be 34% lower compared to men.

Sources: Bureau of Labor Statistics (BLS) and Wells Fargo Investment Institute, as of February 2025. Assumptions: The starting salary for men is the median for men aged 20 – 24, provided by BLS as of December 2024. The starting salary for women is the median for women aged 20 – 24. Salary increases 2% each year with promotions every 5 years accompanied by a 5% salary increase for men. Salary increases are scaled down 83% for women. 3% of salary is contributed to the retirement account each year, increasing by 3% on promotion years until reaching 20% maximum. A two-year career break is factored into women’s salary growth and savings in years 13 and 14. Salary in year 15 is reestablished at the same level as year 12. Salary growth resumes in year 16. Savings contributions are halted during the career break and resume in year 15 at the same level as year 12. Average growth rates are determined by the WIM Analytics study, January 2025.

Closing the gap

A recent survey revealed that women's willingness to invest in the stock market is on the rise. Additionally, over 70% of women agree that investing is a way to build generational wealth, and one in four women are interested in learning about how to start investing.10 Another study indicated that women who are not currently investing are holding back because they do not have enough money, as opposed to not trusting the market.11

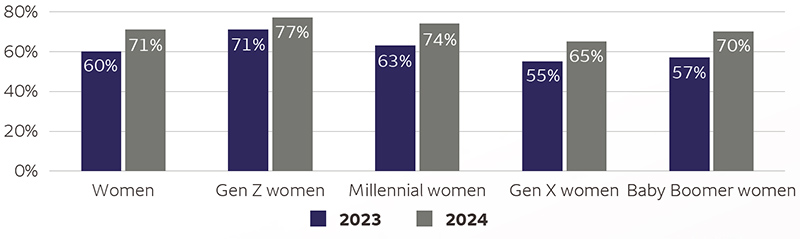

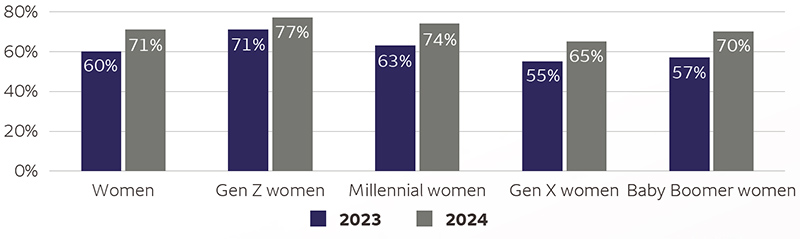

Women are becoming more comfortable investing in the stock market

Younger women continue to invest at a higher rate, but Gen X and Baby Boomer women have started to invest more.

Respondents who invest in the stock market

Sources: 2023 Women's Study, Fidelity Investments, October 2023. 2024 Women and Investing Study, Fidelity Investments, October 2024.

10 2024 Women and Investing Study, Fidelity Investments, October 2024

11 Her Money Mindset Survey, Investopedia and REAL SIMPLE, May 2024

In our study of Wells Fargo Advisors clients, we found that women exhibited several important strengths related to their investment success.

Discipline: Our findings12 show that women tended to have a more disciplined approach to investing that may have contributed to their stronger risk-adjusted returns.13 Likewise, Warwick Business School found that female investors tended to invest in fewer speculative stocks and were less likely to hold on to stocks showing a loss.14

Willingness to learn: Women are more likely to seek education and advice from investment professionals. In our 2021 investor survey, half of women reported working with a personal financial advisor, compared with just under 37% of men.15

Risk-taking: Our study confirmed that, on average, women are more risk-averse than men when it involves managing their individual accounts.16 But that has not held back their ability to achieve attractive risk-adjusted returns.

Women achieved similar returns to men but took significantly less risk. Interestingly, a Harvard study showed that in the areas of social entrepreneurship and impact investing, women take more risk than men. So women’s risk-taking behavior appears to be more context based.17

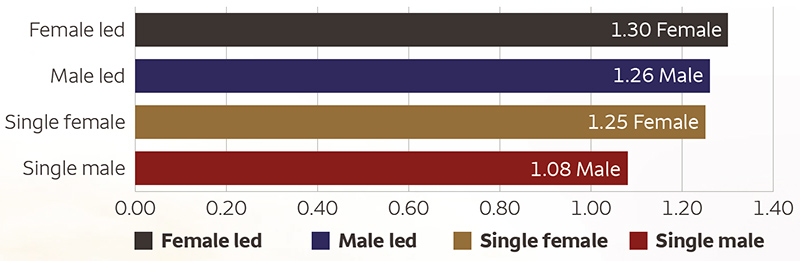

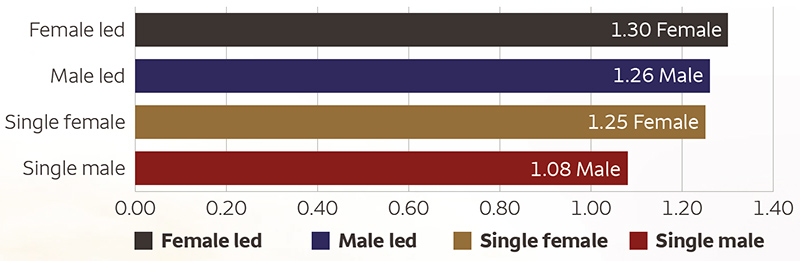

A recent study of Wells Fargo Advisors clients indicates that women have exhibited the ability to generate strong risk-adjusted returns. The study, conducted in January 2025, showed that female-led investment accounts earned the highest absolute returns and the highest risk-adjusted returns. Male-led investment accounts and single men had lower average risk-adjusted returns.18

The takeaway? Many women in our study are effectively managing their own assets and contributing to a stronger investment partnership when the responsibilities are shared.

12,16, 18 Gender Differences in Performance at Wells Fargo Advisors, Wells Fargo Wealth & Investment Management (WIM) Analytics, January 2025. Average annual trades over a seven-year period from January 1, 2018 – December 31, 2024.

13 Risk-adjusted returns represented by return divided by risk.

14 Findings from Warwick Business School, “Are women better investors than men?” June 2018.

15 Wells Fargo/Gallup Investor and Retirement Optimism Index, February 2021. Results for this Wells Fargo/Gallup Investor and Retirement Optimism Index are based on a Gallup Panel™ web study completed by 1,536 U.S. investors, aged 18 and older, from February 8 to 16, 2021. This quarter’s poll includes an oversample of Black and African American investors, resulting in a total of 573 Black and African American investors included in this survey. For this study, the American investor is defined as an adult in a household with stocks, bonds, or mutual funds of $10,000 or more, either in an investment account or in a self-directed IRA or 401(k) retirement account.

17 Harvard Business Review. “How the gender balance of investment teams shapes the risks they take,” December 24, 2020.

Risk-adjusted returns for women and men

Single-female and female-led accounts achieved higher risk-adjusted investment returns than men.

Women’s greater willingness to develop a financial plan, adhere to that plan, and work with an advisor are among the factors we believe led to attractive investment results. In January 2025, the Wealth & Investment Management (WIM) Analytics group updated a 2023 study of Wells Fargo Advisors accounts for which gender information was available. Consistent with the prior study, single-female and female-led households represented about 53% of the study. The study covered the period from January 2018 to December 2024 and supported the results of our earlier study — single-female accounts tend to outperform single-male accounts on a risk-adjusted basis.19Gender Differences in Performance at Wells Fargo Advisors, WIM Analytics, January 2025. Average annual trades over a seven-year period from January 1, 2018 – December 31, 2024.

Source: Gender Differences in Performance at Wells Fargo Advisors, Wealth & Investment Management (WIM) Analytics, January 2025. The total study included more than 50,000 accounts from January 2018 to 2024 with investable assets of $50,000 or more. Excludes advisory accounts. Seven-year time-weighted (or geometric mean) returns net of commissions and fees between January 2018 and December 2024.

Past performance is no guarantee of future results. Performance results represent only the results of the survey.

19 Gender Differences in Performance at Wells Fargo Advisors, Wells Fargo Wealth & Investment Management (WIM) Analytics, January 2025. Average annual trades over a seven-year period from January 1, 2018 – December 31, 2024.

Learn more about investing: Talking with an investment professional or a financial planner can help you understand the basics of investing — things like setting aside enough cash for an emergency, defining your time horizon and risk tolerance, and developing an appropriate asset allocation.

You can also learn about investing by reading financial journals, watching financial news channels to learn the industry terminology, or listening to investment-related podcasts or market updates on the radio.

Setting investment goals: Investment goals can be as varied as the people who define them, but they generally fall into the categories of income, growth, or a mix of the two. Moreover, each of your investment goals will generally have an associated time period that helps determine what type of assets you should potentially use to assist you in reaching your investment goals with the appropriate level of risk.

Preparing for retirement: If retirement is one of your investment goals, you need to consider your expected income from all sources versus your expected expenses. Even if you already are retired, it is still a good practice to periodically evaluate your income and expenses.

A general rule of thumb is that you will need to generate at least 80% of your pre-retirement income when you are retired. Also, women generally live longer than men, so they likely will end up spending more on everything from groceries to health care.

Sharing investment knowledge: Fewer women than men surveyed report being educated by parents on finances and investing.20 But women are taking a different route, with 87% of women reporting educating their children on finances compared with 76% of men. Additionally, three in four women surveyed reported that their children are learning about money and finances at home as opposed to at school or on their own.21

20 Wells Fargo/Gallup Investor and Retirement Optimism Index, February 2021. Results for this Wells Fargo/Gallup Investor and Retirement Optimism Index are based on a Gallup Panel™ web study completed by 1,536 U.S. investors, aged 18 and older, from February 8 to 16, 2021. This quarter’s poll includes an oversample of Black and African American investors, resulting in a total of 573 Black and African American investors included in this survey. For this study, the American investor is defined as an adult in a household with stocks, bonds, or mutual funds of $10,000 or more, either in an investment account or in a self-directed IRA or 401(k) retirement account.

21 Wells Fargo Survey of Affluent Women, March 2021.

Sources: Bureau of Labor Statistics (BLS) and Wells Fargo Investment Institute, as of February 2025. Assumptions: The starting salary for men is the median for men aged 20 – 24, provided by BLS as of December 2024. The starting salary for women is the median for women aged 20 – 24. Salary increases 2% each year with promotions every 5 years accompanied by a 5% salary increase for men. Salary increases are scaled down 83% for women. 3% of salary is contributed to the retirement account each year, increasing by 3% on promotion years until reaching 20% maximum. A two-year career break is factored into women’s salary growth and savings in years 13 and 14. Salary in year 15 is reestablished at the same level as year 12. Salary growth resumes in year 16. Savings contributions are halted during the career break and resume in year 15 at the same level as year 12. Average growth rates are determined by the WIM Analytics study, January 2025.

Sources: Bureau of Labor Statistics (BLS) and Wells Fargo Investment Institute, as of February 2025. Assumptions: The starting salary for men is the median for men aged 20 – 24, provided by BLS as of December 2024. The starting salary for women is the median for women aged 20 – 24. Salary increases 2% each year with promotions every 5 years accompanied by a 5% salary increase for men. Salary increases are scaled down 83% for women. 3% of salary is contributed to the retirement account each year, increasing by 3% on promotion years until reaching 20% maximum. A two-year career break is factored into women’s salary growth and savings in years 13 and 14. Salary in year 15 is reestablished at the same level as year 12. Salary growth resumes in year 16. Savings contributions are halted during the career break and resume in year 15 at the same level as year 12. Average growth rates are determined by the WIM Analytics study, January 2025. Sources: 2023 Women's Study, Fidelity Investments, October 2023. 2024 Women and Investing Study, Fidelity Investments, October 2024.

Sources: 2023 Women's Study, Fidelity Investments, October 2023. 2024 Women and Investing Study, Fidelity Investments, October 2024.

Source: Gender Differences in Performance at Wells Fargo Advisors, Wealth & Investment Management (WIM) Analytics, January 2025. The total study included more than 50,000 accounts from January 2018 to 2024 with investable assets of $50,000 or more. Excludes advisory accounts. Seven-year time-weighted (or geometric mean) returns net of commissions and fees between January 2018 and December 2024. Past performance is no guarantee of future results. Performance results represent only the results of the survey.

Source: Gender Differences in Performance at Wells Fargo Advisors, Wealth & Investment Management (WIM) Analytics, January 2025. The total study included more than 50,000 accounts from January 2018 to 2024 with investable assets of $50,000 or more. Excludes advisory accounts. Seven-year time-weighted (or geometric mean) returns net of commissions and fees between January 2018 and December 2024. Past performance is no guarantee of future results. Performance results represent only the results of the survey.