Power

Harness the power of investing technology with Intuitive Investor®.

- Create your and our algorithms will evaluate your and suggest a portfolio for you.

- Our technology your investments, and rebalances as necessary, to maintain your portfolio’s target asset allocation.

- Mobile friendly. Track your account from your phone.

Each portfolio invests your money into a variety of , diversifying your investment.

Intuitive Investor offers many and supports qualified retirement plan . Take advantage of optional .

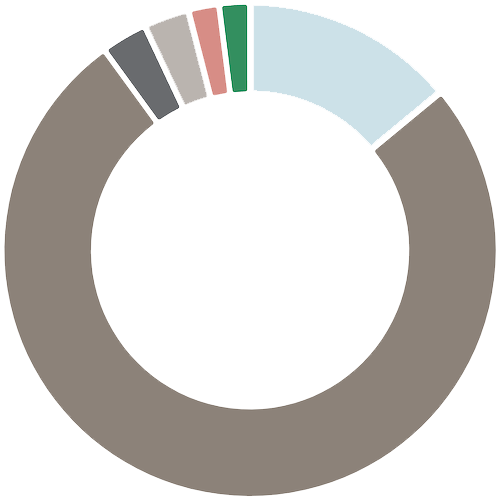

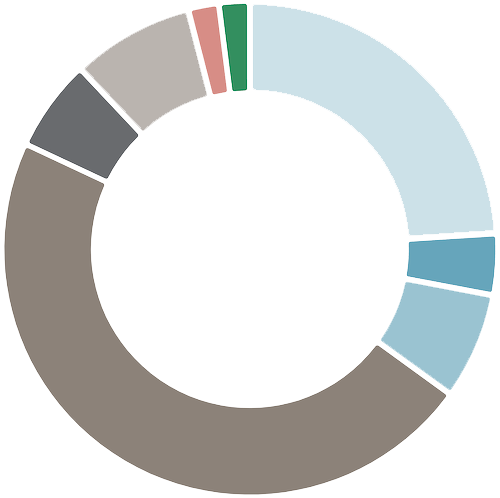

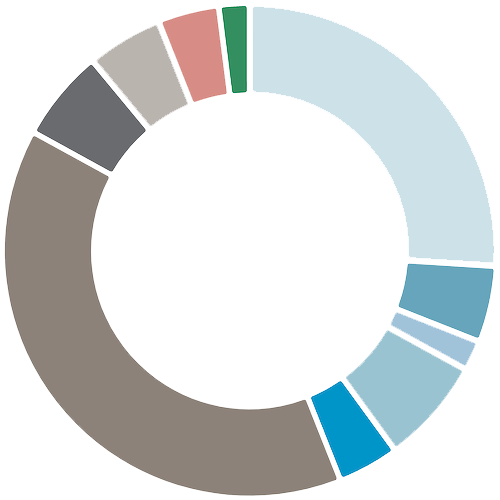

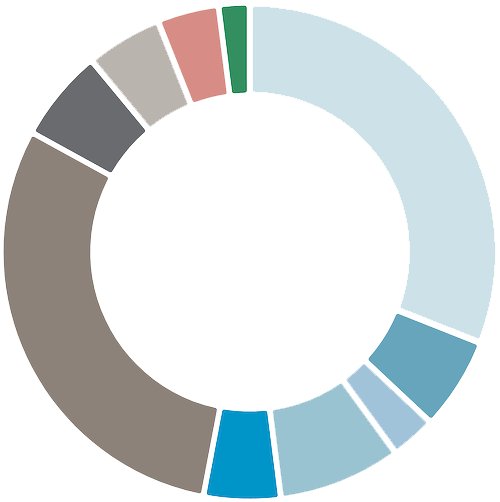

Diversification

Our diversified built by experts are designed to help weather market fluctuations, while seeking the optimal return within each risk level.

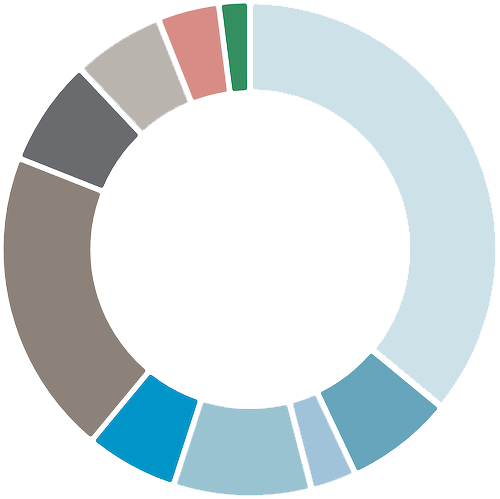

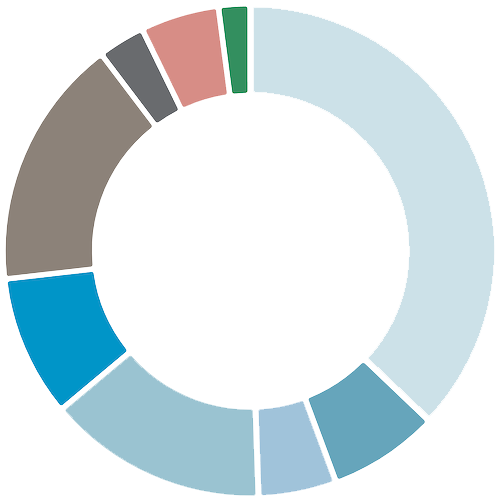

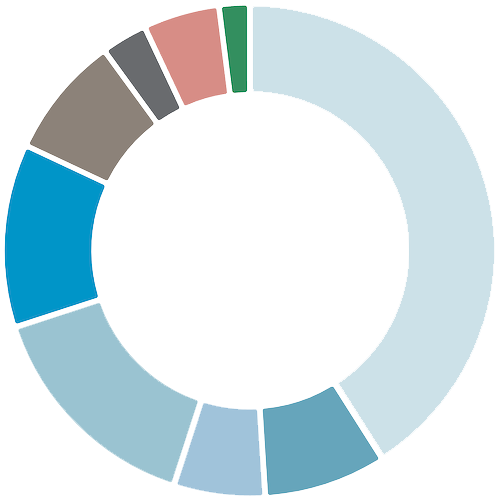

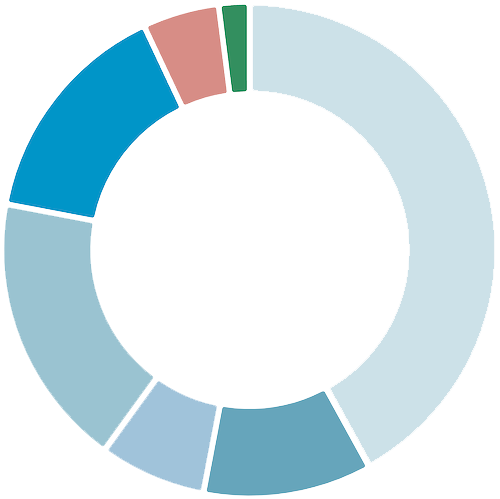

Each point represents a portfolio, ranging from less risky to more risky. Select a point to preview the portfolio’s asset allocation and objective.

Obtain more information about our firm and financial professionals. FINRA's BrokerCheck >

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

Wells Fargo Clearing Services, LLC is not an FDIC-insured depository institution; FDIC deposit insurance only protects against the failure of an insured depository institution. Banking products and services provided by Wells Fargo Bank, N.A. Member FDIC.

The Intuitive Investor program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $500.

Wells Fargo Investment Institute is a registered investment advisor and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

What is an investment profile?

Taking our online investment questionnaire will generate your investment profile, which summarizes your investment goal, risk tolerance, and timeframe. Your portfolio recommendation is based on this profile.

If you experience a change in your financial situation, you should retake the questionnaire to see if your updated responses affect your investment profile.

What is risk tolerance?

Risk tolerance, also known as risk appetite, is the degree of variability (risk) in investment returns that an investor is willing to withstand. We evaluate your risk appetite and recommend a portfolio based on your answers to the Intuitive Investor questionnaire.

What is daily monitoring?

Daily monitoring tracks the performance of individual funds in your portfolio to ensure the asset allocation stays within an acceptable range. It allows for fluctuation within target ranges to avoid unnecessary or ineffective trading and rebalances your account only when needed.

What is an ETF?

An exchange-traded fund (ETF) is a marketable security that tracks an index, commodity, bonds, or basket of assets, like an index fund. Unlike mutual funds, ETFs trade like a common stock on a stock exchange. ETFs are a low-cost way to build a diversified portfolio with investments across 70 countries and multiple economic sectors.

Eligible account types

To open an account, choose from these brokerage account types:

- Individual

- Joint

- Trust

- Custodial (UGMA/UTMA)

- Roth IRA

- Traditional IRA

- SEP IRA

- Inherited Roth IRA

- Inherited Traditional IRA

Rolling over a qualified retirement account

Please keep in mind that rolling over your qualified retirement plan assets to an IRA is just one option. Each option has advantages and disadvantages, and the one that is best depends on your individual circumstances and financial goal. You should consider features such as investment options, fees and expenses, and services offered. Investing and maintaining assets in an IRA will generally involve higher costs than those associated with a qualified retirement plan. We recommend consulting your plan administrator before making any decisions regarding your retirement assets.

What is tax loss harvesting?

Tax loss harvesting, is an optional service for eligible accounts at no additional charge. It is a strategy to potentially reduce your tax liability by selling some stocks at a loss to limit the recognition of short-term capital gains. Short-term capital gains are generally taxed at a higher federal income tax rate than long-term capital gains.

Portfolios

Intuitive Investor portfolios combine traditional market-weighted exchange-traded funds* (ETFs) and Smart Beta ETFs. Traditional ETFs passively track an index using market capitalization to determine security weightings within the fund.

While moderately more expensive than more traditional ETFs, Smart Beta ETFs can provide cost-effective means to gain exposure to investment factors, such as value, momentum, and quality, while reducing the larger-company bias inherent within market-capitalization-weighted approaches.

By thoughtfully combining Smart Beta and traditional lower-cost ETFs within your overall asset allocation strategy, Intuitive Investor portfolios seek cost-effective ways to further enhance diversification and can potentially improve your long-term investment outcomes.

*ETFs are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost.

What is the Wells Fargo Investment Institute?

The Wells Fargo Investment Institute (WFII) is our expert team of investment strategists and analysts.

They research and develop investment strategy, and select the investments for the Intuitive Investor portfolios.

WFII also publish viewpoints on current market conditions to help educate investors.

Some environmental considerations

- Air emissions/quality

- Biodiversity & land usage

- Climate change

- Fossil fuels use

- Green building

- Renewable energy

- Water stress/pollutions

Some social considerations

- Corporate culture

- Consumer protection

- Diversity & inclusion

- Human capital

- Labor standards

- Philanthropic giving/involvement

- Privacy & data security

Some governance considerations

- Accounting

- Board structure

- Business ethics & fraud

- Corruption

- Executive compensation

- Regulatory & compliance record

- Shareholder voting rights