Exchange-Traded Funds

- Passively managed Exchange-traded funds (ETFs) seek to replicate the performance of the index they track.

- ETFs can fit well with other types of investments in the same portfolio.

- ETFs can carry lower management fees than a mutual fund.

A different take on fund investing?

An ETF is an investment fund that holds a basket of stocks, bonds, or other assets. They work in one of two ways. Most ETFs are designed to track the performance of an index, sector, or commodity. Some are actively managed. These ETFs do not seek to track the return of a particular index. Instead they seek to achieve a stated objective.

ETFs trade on an exchange like a stock. They have features similar to mutual funds in the way that you own shares of an overall portfolio. Unlike mutual funds, ETF shares are not individually redeemable from the fund and must be bought and sold on an exchange.

Most ETFs are transparent and typically liquid and low cost. Transparent ETFs disclose their holdings to the public on a daily basis, semi-transparent ETFs do not do this. Semi-transparent ETFs are actively managed and disclose their holdings either monthly or quarterly with a lag, similar to mutual funds.

ETFs in your portfolio

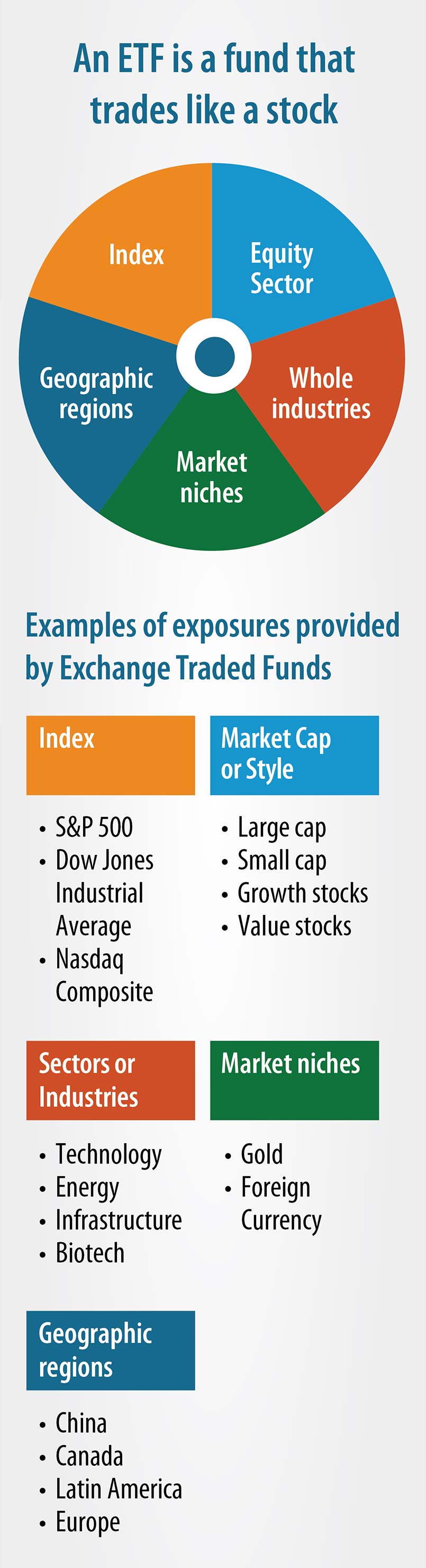

ETFs provide a variety of exposures and can be useful in building a diversified portfolio. You and your Financial Advisor can use ETFs to access broad or specific parts of the market. They can also help provide access to parts of the market not easily accessible to individual investors.

Let’s say you wanted to own all stocks in the S&P 500 Index. It could be difficult and costly. Instead, you could gain this broad exposure through an ETF that tracks the S&P 500 Index. This investment should closely mirror the performance of the underlying index (before expenses) and can be purchased through a single transaction on an exchange.

There are also specialized ETFs. You can invest in both core and alternative asset classes. Keep in mind, ETFs that track commodities are generally not registered with the Securities and Exchange Commission and are not appropriate for all investors. They attempt to track the price of a single commodity, such as gold or oil, or a basket of commodities by holding the actual commodity in storage, or by purchasing futures contracts or other derivative instruments.

ETFs can fit well with other types of investments in the same portfolio. That’s one reason why some investors think of them as portfolio management tools.

Wide variety of Exposures

You may find an ETF for almost every market segment. ETFs can track sector-specific, country-specific, fixed income and broad-market indexes.

Most ETFs are passively managed. This means the investments in the ETF are selected in an effort to match the index tracked. Less common are ETFs that are actively managed or have an investment objective (e.g., to outperform a certain benchmark) as opposed to attempting to replicate the performance of an index.

Bought and sold like stocks

ETFs can be traded throughout the day on national securities exchanges at market prices. This is considered a key benefit because investors can react more quickly to market conditions. A mutual fund is bought or sold at Net Asset Value only at the close of trading on the New York Stock Exchange, which is generally 4:00 p.m. Eastern Time. Keep in mind, ETFs do not sell individual shares directly to investors and only issue their shares in large blocks (blocks of 50,000 shares, for example) that are known as “creation units.” Investors who want to sell their ETF shares can sell individual shares to other investors on the secondary market or they can sell creation units back to the ETF.

The price of your ETF investment will fluctuate during the day with the ups and downs of the market. At times, an ETF may trade higher or lower – at a premium or a discount – from the price of its underlying securities or Net Asset Value (NAV). ETFs continuously offer and sell shares through a daily in-kind purchase and sale process to “authorized participants” and not to investors. As a result, most ETFs do not incur tax when securities are sold and the investor does not incur capital gains taxes until they sell their shares. This process facilitates a tight premium discount to NAV.

You can carry out the same types of trades as you would with a stock. You can also use a market order, limit order, or use a stop-loss order. Please note that investors will typically pay a brokerage commission on each transaction.

Investment cost is low

A single transaction can provide ownership in a basket of investments. It costs less to purchase an ETF than if you tried to acquire all the individual stocks in an index.

ETFs typically carry lower management fees than mutual funds. Fees can vary depending on the fund. Ask your Financial Advisor to help you understand the costs associated with a particular investment.

Know what you own

It’s easy to find out what you own in a transparent ETF. The underlying investment holdings are viewable daily on the fund sponsor’s website. Semi-transparent ETFs disclose their holdings either monthly or quarterly with a lag. Knowing what the fund invests in is important information to understand. This will help you know if you are overweight in a particular stock or industry.

Potentially tax-friendly investments

Most ETFs are passively managed and as such, the investment securities/assets are chosen by predetermined guidelines to match an index or portion of the market. As a result, the portfolio generally has low turnover and usually generates few, if any, capital gains.

While Wells Fargo Advisors does not offer tax advice, it is useful to know ETFs might offer certain tax advantages. Your tax advisor can discuss these with you in greater detail.

ETF dividends

You may receive two types of dividend income from an ETF holding:

Qualified dividends –Qualified dividends are dividends paid to investors in common and preferred stocks of U.S. corporations and those paid by certain foreign corporations. Shareholders must satisfy a certain holding period to qualify for special tax treatment. The tax rate on qualified dividends is 15% or 20%, depending on your income tax bracket.

Non-qualified dividends – Non-qualified dividends are taxed at your ordinary income tax rate. They may come from short-term mutual fund capital gains, real estate investment trusts (REITs), or money market funds, among other sources.

Note that, while rare, ETFs may distribute capital gains at year end.

Next Steps

- Understand the potential investment, cost, and tax advantages of ETFs.

- Learn how to view online the investment holdings within your ETF.

- Ask your Financial Advisor whether ETFs might work in your portfolio.

Wells Fargo Advisors and its affiliates do not provide tax or legal advice. Please consult with your tax and/or legal advisors before taking any action that may have tax and/or legal consequences.